Case studies

Pieces of Profit: How LKQ Made Salvage a Business Empire

Dec 2024

When I first visited LKQ’s Belleville, Michigan facility in 2007, I expected a typical salvage yard—scrapyards, scattered car parts, and maybe a few racks of inventory. What I saw instead was a business operating like clockwork, squeezing value out of every vehicle it touched. From their handheld computers guiding car valuations to recycling fluids to heat their warehouses, it was clear LKQ wasn’t just scrapping cars—they were building an empire.

And that empire’s growth tells a fascinating story, not just about innovation and resourcefulness, but also about bold moves like the Keystone acquisition that reshaped the company and its stock performance.

A History of Growth and Strategy

LKQ started in 1998 with a simple but powerful idea: consolidate the fragmented, mom-and-pop salvage yard industry and turn it into a scalable, modern business. Back then, local yards operated independently, with no way to coordinate inventories or standardize pricing. LKQ changed that by buying up these small operations and implementing systems that turned chaos into order.

- The Early Days: During the late 1990s and early 2000s, LKQ’s growth was fueled by acquisitions. They bought salvage yards across North America, integrated their operations, and optimized them with barcoding, inventory management, and centralized pricing systems.

- Organic Growth: While acquisitions were the primary growth driver, LKQ also steadily expanded its customer base by offering new product categories, like remanufactured engines and transmissions, which added revenue streams without requiring new purchases.

Stock Performance (1998–2007)

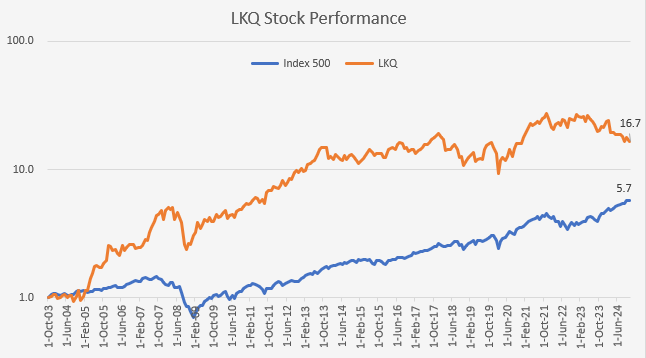

LKQ went public in 1999, and investors quickly saw the potential. Between 1998 and 2007, the company grew its revenue from almost nothing to $2 billion. The stock price followed suit, rising steadily as LKQ’s consolidation strategy and early organic growth showed tangible results.

The Keystone Acquisition: A Game-Changer

In 2007, LKQ made a bold move: they acquired Keystone Automotive Industries for $811 million. Keystone specialized in new aftermarket collision parts—fenders, bumpers, lights, and other body components. For LKQ, this was a major pivot. They were no longer just a salvage company; they were becoming a full-spectrum auto parts supplier. After visiting the company, it was clear to me at the time that the deal made perfect sense. Years later, I discussed the experience with another investor who had been with me on that visit. When I asked how much they had invested in the stock, they admitted they hadn’t. Their response was, “That’s okay—opportunities like this come up all the time.” I couldn’t have disagreed more. To me, opportunities that inspire true conviction are incredibly rare. In fact, LKQ stood out so strongly that it became my top pick at my firm for several years afterward.

- Why Keystone Mattered: During my visit to Belleville, a service rep summed it up perfectly: “If I had more inventory, I could sell more.” That’s exactly what Keystone delivered—new aftermarket parts to complement their salvaged and remanufactured inventory.

- One-Stop Shop: With Keystone, LKQ became a one-stop supplier for collision repair shops and insurers, offering both salvaged OEM parts and brand-new aftermarket options.

- Revenue Impact: Keystone added billions to LKQ’s revenue, helping it grow from $2 billion in 2007 to over $4 billion by 2011.

Stock Performance (2007–2012)

Initially, the market took some time to digest the acquisition. But as the integration took hold and Keystone’s contribution to revenue became clear, LKQ’s stock more than doubled between 2007 and 2012. Even the financial crisis of 2008–2009 couldn’t derail their momentum, as demand for replacement parts surged during a time when fewer people were buying new cars.

Adding Value for Insurance Companies

One of LKQ’s secret weapons has always been its relationship with insurance companies. Insurers play a huge role in deciding how cars get repaired after collisions, and LKQ positioned itself as their go-to partner.

Here’s why insurers love LKQ:

- Cost Savings:

Salvaged OEM and Keystone’s aftermarket parts are far cheaper than new OEM parts, helping insurers control claim costs. - Reliability and Speed:

LKQ’s vast distribution network means parts are delivered quickly, reducing claim cycle times and getting customers back on the road faster. - One-Stop Convenience:

With LKQ, insurers don’t have to deal with multiple suppliers. Whether it’s a used engine, a remanufactured transmission, or a new aftermarket bumper, LKQ can deliver it all in one order.

During my visit, it was clear how this relationship worked in real time. The Belleville facility was a well-oiled machine, designed to meet the demands of repair shops and insurers alike. It wasn’t just about selling parts—it was about offering solutions that made life easier for everyone involved.

Becoming a Global Powerhouse

After Keystone, LKQ didn’t stop. The company continued expanding, especially internationally:

- Europe: LKQ acquired Euro Car Parts and other distributors, becoming a dominant player in the European aftermarket.

- New Niches: They added specialty parts for performance, off-road, and heavy-duty vehicles, further diversifying their offerings.

Stock Performance (2013–2019)

By the mid-2010s, LKQ was no longer a scrappy growth company—it was a mature, global leader. The stock saw steady gains during this period, reflecting its consistent revenue growth (which hit $12 billion by 2019) and improving profitability.

Financial Model and Margins

LKQ’s financial engine runs on multiple revenue streams:

- Salvaged OEM Parts: High-margin products sourced from wrecked cars.

- Remanufactured Components: Engines, transmissions, and alternators—reliable and cost-effective, with mid-range margins.

- New Aftermarket Parts: Lower-margin but high-volume parts from Keystone.

- Recycling and Scrapping: Incremental revenue from fluids, wires, and leftover metal carcasses.

Margins and Profitability:

- Gross margins typically hover around 35–40%, driven by the mix of high-margin salvage parts and lower-margin aftermarket parts.

- Operating margins range from 8–12%, reflecting LKQ’s ability to leverage scale and control costs.

The Pandemic and Recovery (2020–Present)

Like most companies, LKQ faced challenges during the pandemic. Miles driven plummeted in 2020, reducing demand for replacement parts. But as driving patterns normalized, LKQ rebounded quickly.

- Post-Pandemic Tailwinds: Supply chain disruptions made OEM parts harder to source, driving more repair shops toward salvaged and aftermarket parts. This was a boon for LKQ.

- Stock Performance: After dipping in 2020, the stock bounced back strongly, supported by LKQ’s consistent cash flows and a renewed focus on shareholder returns through buybacks.

Why LKQ Stands Out

Looking back, LKQ’s success comes down to three key factors:

- Strategic Growth: From consolidating salvage yards to acquiring Keystone and expanding globally, LKQ has always played the long game.

- Value for Customers: Whether it’s insurers, repair shops, or DIYers, LKQ delivers cost-effective, high-quality parts with speed and reliability.

- Resourcefulness: At Belleville, I saw firsthand how every part of a salvaged car was used—fluids for heating, wires for recycling, and every usable component cataloged and sold.

Applying Lessons from LKQ for Investors

Here are some key takeaways and how they can be applied to your investment strategy:

1. Identify Companies with Scalable Business Models

LKQ’s early success came from recognizing a fragmented, inefficient industry—auto salvage—and creating a scalable, modern business out of it. Their consolidation of small salvage yards into a standardized, technology-driven operation was the foundation for their growth.

Investor Lesson:

Look for companies operating in fragmented industries where consolidation can drive scale, efficiency, and market dominance. These businesses often have significant growth potential, especially if they can apply technology to streamline operations.

- What to Look For: Companies that demonstrate early signs of scalability, such as investments in infrastructure, technology, or processes that can be replicated across markets.

2. Understand the Power of Diversification

LKQ’s transformation wasn’t just about scaling salvage—it was about diversifying their product offerings. By moving into remanufactured parts and, later, new aftermarket parts (through Keystone), they reduced their reliance on any one revenue stream or customer segment. This made the company more resilient to industry fluctuations, like changes in salvage vehicle supply or collision rates.

Investor Lesson:

Diversification—whether in product lines, customer segments, or geographic markets—can make a company more resilient to external shocks. Companies that diversify intelligently, while staying close to their core competencies, often create more consistent long-term value.

- What to Look For: Companies expanding into complementary products or services that add value to existing customers without overextending their expertise.

3. Evaluate Acquisition Strategies Carefully

LKQ’s growth has been driven by strategic acquisitions, most notably Keystone. The success of these deals came down to three factors:

- Acquiring businesses that expanded their product offering or market reach.

- Integrating acquisitions effectively to realize synergies.

- Using acquisitions to drive economies of scale.

However, not all acquisitions are created equal—poorly planned or overpriced deals can destroy value.

Investor Lesson:

Acquisitions can be a powerful growth tool, but they must align with a company’s long-term strategy and show a clear path to synergies or profitability.

- What to Look For: Companies with a proven track record of integrating acquisitions successfully. Monitor how acquisitions impact margins, debt levels, and overall financial performance.

4. Relationships with Key Stakeholders Matter

LKQ’s strong relationships with insurance companies are a cornerstone of its success. By offering insurers cost savings, reliability, and convenience, LKQ became a preferred supplier for direct repair programs. This created a steady, recurring revenue stream.

Investor Lesson:

Companies that build strong partnerships with key stakeholders—whether customers, suppliers, or regulators—gain competitive advantages that are hard to replicate.

- What to Look For: Evidence of long-term contracts, recurring revenue from major customers, or relationships that provide a strategic moat.

5. Balance Between Growth and Margins

While LKQ has historically grown through acquisitions, they’ve also focused on maintaining strong margins. Keystone’s lower-margin aftermarket parts were offset by high-margin salvage parts and economies of scale from integration. This balance allowed LKQ to grow while preserving profitability.

Investor Lesson:

Revenue growth is important, but it shouldn’t come at the expense of margins. A company that can grow while maintaining or improving profitability demonstrates disciplined management.

- What to Look For: Consistent or improving gross and operating margins alongside revenue growth.

6. Recognize Resilience in Challenging Markets

LKQ’s stock performance during periods like the 2008 financial crisis and the 2020 pandemic highlights their ability to adapt to market challenges. In both cases, LKQ benefited from increased demand for lower-cost parts when economic conditions pressured consumers and insurers to save money.

Investor Lesson:

Companies that provide cost-effective solutions or essential goods and services tend to perform well during economic downturns. These businesses often make excellent long-term investments because they thrive in both good and bad times.

- What to Look For: Companies offering value-oriented products or services that meet customer needs regardless of economic conditions.

7. Focus on Stock Buybacks and Capital Allocation

In recent years, LKQ has used its strong cash flows to execute stock buybacks, signaling confidence in its future and returning value to shareholders. Prudent capital allocation—whether through buybacks, dividends, or reinvestment—is a sign of disciplined management.

Investor Lesson:

Companies that allocate capital effectively often deliver better long-term returns. Stock buybacks can enhance shareholder value, but only when done at reasonable valuations.

- What to Look For: Companies with a history of disciplined capital allocation and a clear strategy for using cash flow to benefit shareholders.

8. Analyze Industry Trends and Tailwinds

LKQ has benefited from long-term trends like increased miles driven, rising collision rates, and a growing preference for cost-effective aftermarket parts. Their ability to align their business model with these trends has been key to their growth.

Investor Lesson:

Invest in companies positioned to benefit from macroeconomic or industry-specific tailwinds. Businesses that adapt to or align with these trends are more likely to succeed.

- What to Look For: Companies addressing growing markets, shifting consumer preferences, or technological advancements.

9. Watch for Signs of Moats

LKQ’s scale, inventory, and insurer relationships create a competitive advantage that’s hard to replicate. Their ability to offer a one-stop shop for repair shops and insurers makes them indispensable in the automotive repair ecosystem.

Investor Lesson:

Companies with durable competitive advantages—or "moats"—tend to outperform over the long term. These could be economies of scale, brand strength, network effects, or strategic partnerships.

- What to Look For: Evidence of competitive advantages that are growing stronger over time, not eroding.

10. Learn from LKQ’s Stock Performance

LKQ’s stock performance demonstrates the importance of identifying growth companies early, recognizing transformative acquisitions, and staying the course through short-term market volatility.

Investor Lesson:

Stock performance often lags behind business performance during major transitions. If the fundamentals are strong, short-term market fluctuations can create buying opportunities.

- What to Look For: Companies with consistent earnings growth, a history of delivering on strategic initiatives, and attractive valuations during market pullbacks.

Conclusion: Applying LKQ’s Lessons to Your Portfolio

LKQ’s story is a masterclass in how to build a market leader through strategic acquisitions, operational excellence, and strong stakeholder relationships. For investors, it highlights the value of scalable business models, diversification, and disciplined growth. By looking for companies that replicate these traits—especially those operating in fragmented or growing industries—you can identify opportunities that deliver strong returns over the long term.

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in LKQ Corporation. (LKQ). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.