Case studies

BIRD: Reality Disconnect and the -99% Tailspin

Dec 2024

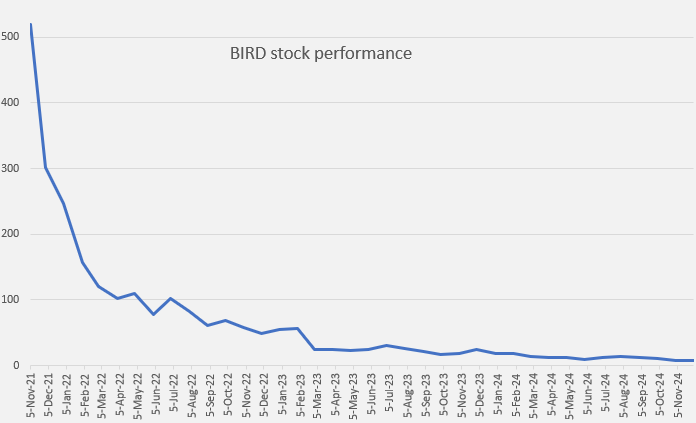

Allbirds, founded in 2014, quickly rose to prominence by introducing sustainable and minimalist footwear that resonated with environmentally conscious consumers. Co-founders Tim Brown, a former New Zealand soccer player, and Joey Zwillinger, a renewable materials expert, set out to disrupt the traditional footwear industry by combining comfort, simplicity, and eco-friendly materials. Their vision propelled the company from a Kickstarter success to a publicly traded firm valued at $4.1 billion at its IPO in 2021. Allbirds raised $240 million during its IPO, but much of that capital has been depleted, resulting in significant shareholder value destruction. Today, the company’s market value has plummeted to a mere $57 million.

Allbirds framed itself as not just a shoe company but a lifestyle brand, poised for massive growth. However, post-IPO struggles revealed a deeper issue: a disconnect between management’s optimistic framing of the company and its competitive reality.

Management Framing: "We Are a Lifestyle Brand"

Competitive Reality: Lifestyle brands succeed by dominating their core category first.

Allbirds positioned itself as more than a shoe company—a lifestyle brand embodying sustainability, comfort, and simplicity. However, lifestyle brands like Nike and Lululemon succeeded because they mastered their primary market (performance footwear and activewear, respectively) before expanding into adjacent categories. Allbirds tried to achieve lifestyle status too soon, diversifying into apparel and performance shoes without first securing dominance in casual footwear. This led to unfocused messaging and diluted resources.

Lesson:

Investors should be cautious when companies claim "lifestyle" positioning before proving success in their core category. Strong management doesn’t just frame ambition; it delivers measurable results in the primary market before branching out.

Management Framing: "Sustainability Sets Us Apart"

Competitive Reality: Sustainability is now a minimum requirement, not a differentiator.

Allbirds marketed itself as a pioneer in eco-friendly footwear, but the competitive environment shifted rapidly. Established brands like Nike and Adidas launched sustainability-focused lines, while new entrants like Veja and Rothy’s adopted similar narratives. As a result, sustainability became a baseline expectation rather than a unique selling point. Management’s continued emphasis on sustainability as a competitive moat missed the reality: the company needed to innovate beyond this initial advantage to maintain differentiation.

Lesson:

Investors should evaluate whether a company’s differentiation is durable or easily replicated. Management framing often overstates the defensibility of early advantages, but competitive analysis can reveal whether those advantages remain relevant over time.

Management Framing: "The Most Comfortable Shoes"

Competitive Reality: Comfort is subjective, and durability and performance matter just as much.

Allbirds’ value proposition centered on comfort, which appealed to early adopters. However, as competitors introduced equally comfortable products with greater durability and performance, Allbirds struggled to justify its premium pricing. Management’s focus on “comfort” overlooked the evolving needs of customers, particularly in categories like athletic and performance footwear. Consumer reviews began to reflect concerns about durability, which weakened the brand’s credibility.

Lesson:

Management often frames their product strengths in ways that resonate with initial adopters but fail to anticipate broader market demands. Investors should monitor customer feedback and competitor innovations to gauge whether the company is adapting to evolving consumer expectations.

Management Framing: "Direct-to-Consumer Success"

Competitive Reality: Scaling DTC brands requires a broader omnichannel strategy.

Allbirds thrived in its early days with a direct-to-consumer (DTC) model, which allowed it to build a strong connection with customers and control its brand experience. Management touted this model as a key strength, but DTC alone couldn’t support the company’s growth ambitions. Competitors with omnichannel strategies—retail stores, online marketplaces, and partnerships—had greater reach and efficiency, making it harder for Allbirds to compete at scale. Management’s reluctance to adapt its distribution strategy slowed its ability to capture new markets.

Lesson:

Investors should question whether management’s framing of their go-to-market strategy aligns with the realities of scaling. Successful companies evolve beyond their initial business models as they grow.

Management Framing: "We’re Growing Rapidly Post-IPO"

Competitive Reality: Growth must be profitable and sustainable.

During its IPO, Allbirds emphasized its strong growth trajectory, fueled by category expansion and global ambitions. However, competitive pressures and high costs associated with sustainable materials strained margins. Growth slowed post-IPO, and management faced criticism for prioritizing expansion over profitability. This reflects a common post-IPO challenge: companies often highlight their growth potential while downplaying risks associated with scaling.

Lesson:

Investors should look beyond management’s growth narrative to assess unit economics and the sustainability of that growth. Pay close attention to profitability metrics and the competitive forces that might erode market share over time.

Management Framing: "We’re Innovators in Footwear"

Competitive Reality: True innovation balances sustainability, durability, and performance.

Allbirds innovated with materials like merino wool and sugarcane-based SweetFoam™, which aligned with its sustainability ethos. However, competitors quickly introduced similar innovations while also improving durability and performance. Allbirds struggled to keep pace with these advancements, undermining its claim to leadership in innovation.

Lesson:

Investors should evaluate whether a company’s innovation pipeline addresses all key customer priorities—not just the ones management emphasizes. Leadership in one aspect (e.g., sustainability) must be matched by strength in others (e.g., durability, performance) to sustain competitive advantage.

Five Forces

Let's examine through the lens of the five forces:

Threat of New Entrants: High

The footwear and apparel market has become increasingly accessible due to advancements in technology and the rise of direct-to-consumer (DTC) business models. New brands like Cariuma and Veja have entered the sustainable footwear space, targeting the same eco-conscious demographic as Allbirds. While Allbirds initially stood out as a pioneer in sustainable design, the barriers to entry for new competitors have lowered significantly. Sustainability, once a differentiator, is now a common claim among both new entrants and established brands. This intensifies the challenge for Allbirds to maintain its market share and stand out in an increasingly crowded field.

Bargaining Power of Buyers: High

Consumers hold substantial power in this market. They face minimal switching costs when choosing between footwear brands, particularly as many now offer similar sustainable products. Allbirds’ initial value proposition—comfort and sustainability—no longer guarantees loyalty when competitors, such as Nike and Adidas, offer products that combine sustainability with better performance or durability. Additionally, as sustainability becomes mainstream, buyers expect these features at lower price points. For Allbirds, maintaining premium pricing while addressing durability and performance concerns is critical to retaining and expanding their customer base.

Bargaining Power of Suppliers: Moderate

Allbirds relies on unique, sustainable materials like merino wool, sugarcane-based soles, and eucalyptus fibers. While these materials align with the company’s brand ethos, they also create dependency on specialized suppliers. If suppliers face disruptions or increase costs, Allbirds has limited alternatives without compromising its sustainability commitments. Balancing material quality with cost-efficiency is crucial, as supply chain challenges can directly impact margins in an already competitive environment.

Threat of Substitutes: High

The market offers an abundance of substitutes, ranging from performance footwear by Nike and Adidas to budget-friendly, everyday options. Within the sustainability niche, brands like Veja and Rothy’s have carved out their own space, providing alternatives that appeal to eco-conscious consumers. Allbirds risks being overshadowed as a generalist in this segment. The company has yet to establish dominance in either performance-oriented footwear or lifestyle appeal, leaving it vulnerable to brands that offer more specialized or versatile products.

Industry Rivalry: Very High

The footwear and lifestyle apparel market is highly competitive, characterized by intense rivalry among major players like Nike, Adidas, and Lululemon. These companies have vast resources for innovation, marketing, and global distribution, making it difficult for smaller brands like Allbirds to compete on scale. Furthermore, emerging direct-to-consumer brands have adopted similar sustainability narratives, increasing competition for the same customer base. Price competition, frequent promotional activity, and the need for constant innovation further escalate the intensity of industry rivalry.

Key Takeaways

Porter’s Five Forces reveal that Allbirds operates in a challenging environment with significant pressures:

- Competitive Saturation: The brand faces increasing difficulty in differentiating itself in a crowded market.

- Erosion of Early Advantage: While sustainability gave Allbirds an initial edge, competitors have quickly closed the gap.

- Cost Pressures: Dependence on specialized materials and the need for constant innovation add strain to profitability.

To succeed, Allbirds must redefine its value proposition. This could involve improving product durability and performance, narrowing its focus to a specific niche, or finding new ways to differentiate itself within the sustainability space.

Conclusion

Allbirds’ journey highlights the dangers of relying too heavily on a polished management narrative without examining the underlying competitive realities. While the company succeeded in capturing early attention and goodwill, its inability to adapt to shifting consumer preferences and competitive dynamics exposed significant weaknesses.

For investors, this case study underscores the importance of critical analysis. Management framing often tells an aspirational story, but the truth lies in execution, market positioning, and the ability to respond to challenges.

Allbirds serves as a cautionary tale: even the most compelling stories can unravel if they’re not grounded in durable competitive advantages and effective execution.

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in Allbirds. (BIRD). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.