Case studies

WOOF: Caring for Pets, Delivering Profits: VCA’s Winning Formula

Dec 2024

VCA Antech was founded in 1986 by Dr. Michael D. Baughman, a veterinarian who saw an opportunity to consolidate the highly fragmented veterinary market. Instead of building practices from the ground up, VCA focused on acquiring existing veterinary hospitals to expand its presence. VCA rose to prominence by capitalizing on economies of scale, offering sophisticated veterinary care, and leveraging its size to gain competitive advantages over smaller clinics. This strategy helped VCA grow quickly, and in 1997, the company went public, listing on the Nasdaq under the ticker symbol "WOOF."

Competitive Strategy and Market Position

VCA’s competitive strategy revolved around leveraging its size and scale to offer higher-end services that smaller, independent veterinary clinics could not match. With the resources to invest in advanced medical equipment, cutting-edge diagnostic tools, and a nationwide marketing effort, VCA became a dominant force in the industry. Smaller clinics often struggled to compete with VCA’s expansive infrastructure and its ability to attract more customers. The company’s marketing efforts, which included a 40-person sales force and direct-to-consumer marketing campaigns, helped it to drive growth in same-store sales. Over time, VCA became the go-to provider for pet owners seeking high-quality care and diagnostic services.

A key part of VCA’s success was its acquisition strategy. The company aimed to acquire 15 to 25 veterinary hospitals per year, growing its network while improving margins within months of taking over new locations. Acquisitions were highly accretive to VCA as they were typically able to purchase hospitals for 4-5x pretax cash flow. With a focus on operational efficiency and economies of scale, VCA was able to quickly improve the margins of acquired hospitals, sometimes boosting profitability by up to 25% within just one or two months.

Despite the company’s market leadership, it faced challenges. VCA had a high debt load, around 83% debt to capital, which it incurred from a private buyout in 2000. This elevated debt level constrained its ability to pursue additional acquisitions. However, VCA was able to navigate this challenge by generating significant free cash flow, around $100 million annually, which supported its acquisition strategy.

Here's an in-depth analysis of its competitive position:

1. Market Leadership and Size

- Scale Advantage: VCA was the largest operator in the fragmented veterinary market, with 225 hospitals, which placed it far ahead of its nearest competitors. It held a dominant share in both veterinary hospitals (approximately 1%) and veterinary lab services (roughly 40% of the market, with $160 million in revenue from a $400 million market).

- Economies of Scale: VCA's large size enabled it to achieve economies of scale, especially in purchasing medical supplies, equipment, and in its ability to negotiate favorable deals with suppliers like Henry Schein. This gave VCA a cost advantage over smaller competitors who lacked the volume of business to secure similar terms.

2. Strategic Focus on Acquisition and Expansion

- Aggressive Acquisition Strategy: VCA aimed to acquire 15-25 hospitals per year, often at 4-5x EBITDA, allowing the company to rapidly expand its network. By acquiring smaller hospitals and improving their margins (from 15-20% to 25%) within a short timeframe, VCA could quickly enhance its profitability and market share. With around 2,000 hospitals meeting its acquisition criteria, there was significant potential for continued consolidation.

- Lab Business: VCA also dominated the veterinary lab services sector, serving over 13,000 veterinary hospitals across the U.S. The company's lab business benefited from strong customer loyalty and sophisticated technology in diagnostics, which set it apart from smaller, less-capitalized competitors.

3. Customer Loyalty and Brand Strength

- Brand Recognition: VCA had established itself as a trusted brand in the pet care industry. With increasing pet ownership and growing willingness among owners to spend on their pets' health, VCA capitalized on the emotional connection pet owners have with their animals. Pet owners are generally loyal to vets that provide high-quality care, creating a stable revenue stream for VCA.

- Customer-Centric Strategy: Customers often prioritize familiarity, convenience, and proximity when selecting a veterinary service. VCA's large network of hospitals and its marketing efforts—via a 40-person sales force and direct-to-consumer marketing—helped drive increased client intensity. VCA’s customer service focus strengthens loyalty, ensuring long-term revenue growth.

4. Competitive Threats

- Barriers to Entry: While VCA was a leader in its field, it faced the threat of new entrants. Large, well-financed firms, such as human diagnostics companies (e.g., Quest Diagnostics), could potentially enter the veterinary lab market. This would pose a direct challenge to VCA's dominance in the lab business, especially since lab margins (37%) are attractive to competitors.

- Banfield and Other Competitors: Banfield, which has rapidly expanded within PetSmart stores, posed a significant competitive threat due to its large customer base and strong marketing. Moreover, Patterson Dental’s push to consolidate the veterinary supply market could have also increased competition for supplies and impact VCA's cost structure.

- Fragmented Market: The veterinary industry itself is highly fragmented, with 60,000 veterinarians practicing across 20,000 hospitals. While VCA was the largest player, its market share was still small relative to the total addressable market. This left room for competitors to grow and potentially challenge VCA's position.

5. Competitive Advantages

- Superior Technology and Expertise: VCA's in-house diagnostics, imaging, and lab services offered a clear competitive edge over smaller, less-equipped veterinary clinics. As veterinary care became more sophisticated, VCA's ability to provide advanced treatments and tests positioned it as the preferred provider for more discerning pet owners.

- Customer Willingness to Pay: As pet owners treat their pets more like family members, spending on veterinary services is increasing. VCA benefited from this trend, particularly as pet insurance became more widespread (currently at only 5% penetration in the U.S.).

- Strong Relationships with Veterinarians: The company employed over 750 veterinarians and maintained strong relationships with these professionals. This created a competitive moat, as VCA had a consistent supply of trained talent for its hospitals and labs. Veterinarians often prioritized lifestyle and enjoyment of caring for animals over running a business, so VCA was able to handle the necessary business functions.

6. Financial Strength and Debt Challenges

- High Leverage: VCA’s use of debt (83% debt-to-capital ratio) was a significant factor in its strategy. This leverage was used to fuel acquisitions during the 2000 buyout, but it limit flexibility in terms of future investments and acquisitions. However, VCA's free cash flow generation ($100 million annually) helped mitigate this risk, providing some cushion for ongoing expansion.

- Ability to Raise Capital: The company had a strong track record of leveraging the capital markets to strengthen its balance sheet. This enabled VCA to continue growing despite its high leverage, allowing it to fund acquisitions and investments.

Financial Performance and Same-Store Sales Growth

VCA’s financial model was built on steady revenue growth driven by both organic growth and acquisitions. Its same-store sales performance was strong in both its hospital and lab segments, with typical same-store sales growth of 6-7% for hospitals and 11% for lab services. This was reflective of broader trends in the pet care industry, where increasing pet ownership and rising pet care spending drove demand for veterinary services.

The company’s strategy of focusing on high-quality, high-margin services, such as in-house diagnostics and specialized treatments, enabled it to expand its market share. The pet care industry was growing at a rate of 7% annually, and VCA was well-positioned to benefit from this trend. The increasing willingness of pet owners to spend more on their pets, driven by a growing awareness of the importance of veterinary care, was a key factor contributing to VCA’s strong same-store sales growth.

Trends in Pet Ownership and Their Impact on VCA

Pet ownership trends were highly favorable for VCA. The pet population in the U.S. was steadily increasing at a rate of 2.1% annually, with approximately 62% of U.S. households owning pets. This growing pet population meant an expanding customer base for VCA’s services. Furthermore, the willingness of pet owners to spend on their pets was rising. According to surveys by the American Veterinary Medical Association, pet owners were willing to spend an average of $92 per month on pet care. The trend of treating pets like family members, with owners increasingly viewing their pets as children, was accelerating. This provided a solid foundation for continued growth in demand for veterinary services.

VCA’s lab business also benefited from this trend, as pet owners sought more advanced diagnostic testing for their pets. The company’s lab services, which accounted for 33% of its revenue, became a key revenue driver. VCA served over 13,000 veterinary hospitals in the U.S., with a portfolio of sophisticated diagnostic services. The lab division’s performance was a reflection of the increasing sophistication of veterinary care and the willingness of pet owners to invest in cutting-edge treatments for their animals.

Challenges and Risks

While VCA’s market position was strong, it faced several risks. A significant challenge was its high debt load, which could limit its ability to pursue new acquisitions. Additionally, the veterinary market was highly fragmented, with approximately 60,000 veterinarians practicing in 20,000 hospitals. While VCA had the largest share of the market, at around 1%, it was still competing in a market that was growing and could attract new entrants. In particular, the rapid expansion of Banfield, which partnered with PetSmart stores, posed a threat to VCA’s acquisition strategy.

Another potential risk came from the laboratory side. Human diagnostic companies, such as Quest Diagnostics, could potentially enter the animal diagnostics market. These companies already had the expertise and scale to compete, and with margins in the lab business as high as 37%, it could be an attractive market for larger players. However, VCA’s established market presence and economies of scale gave it a competitive edge.

The Mars Acquisition and Legacy

In 2017, VCA Antech was acquired by Mars, Inc., which enabled the company to continue its growth trajectory under new ownership. Mars brought additional financial resources to the table, which helped VCA overcome the challenges posed by its high debt load and enabled further expansion.

Looking back, VCA’s success was driven by a combination of strategic acquisitions, strong financial performance, and a keen understanding of pet ownership trends. The company’s ability to expand its market share, improve margins, and capitalize on rising pet care spending solidified its position as a leader in the veterinary care industry.

In conclusion, VCA Antech’s journey offers a great case study of how a well-executed competitive strategy, combined with a deep understanding of market trends and effective financial management, can lead to industry leadership and sustained growth. Its ability to adapt to the growing demand for pet care, leverage economies of scale, and maintain a strong financial position allowed it to thrive in a competitive and fragmented market, setting the stage for a successful acquisition by Mars.

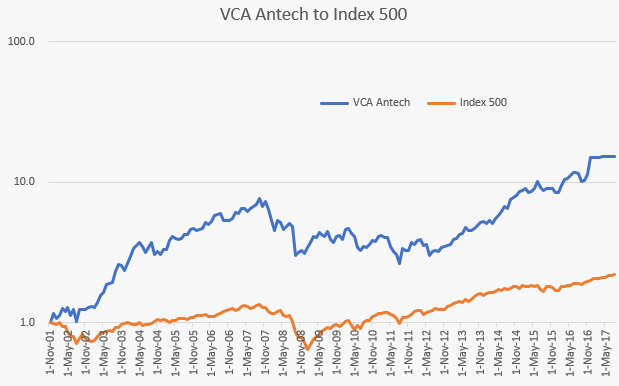

As depicted in the chart above VCA Antech's stock performance (WOOF) saw different phases before, during, and after the Great Recession, driven by various macroeconomic conditions, changes in the pet care market, and company-specific factors, but was overall strong. The stock appreciated 15x from initial public offering for an annualized return of 19% compared to the broader market annualized return of 5%. Here's a summary of the stock's performance during various macro conditions:

Pre-Great Recession (Before 2007)

In the years leading up to the Great Recession, VCA stock performed well, benefitting from the company’s aggressive growth strategy, which was largely driven by acquisitions of veterinary hospitals and labs. From the late 1990s through the mid-2000s, VCA expanded its footprint significantly, positioning itself as one of the largest players in the veterinary services market. During this period, VCA was a market leader in both the hospital and laboratory segments, building a strong competitive position in a fragmented industry.

Key Drivers of Stock Performance:

- Acquisitions: VCA’s strategy of acquiring veterinary hospitals helped fuel consistent revenue growth. Its ability to integrate acquisitions quickly and improve margins at newly acquired locations was a strong driver of investor confidence and stock price performance.

- Market Trends: The growing trend of pet ownership and increasing spending on pet health played a significant role in boosting investor expectations. Pets were increasingly viewed as family members, and consumers were willing to spend more on veterinary care.

- Strong Same-Store Sales: VCA’s ability to grow revenue at existing locations, often due to cross-selling diagnostic services and its reputation for quality care, helped drive stock price appreciation.

During the Great Recession (2007-2009)

The Great Recession of 2007-2009 had a notable impact on the broader stock market, and VCA was not immune to the downturn. However, VCA’s performance during the recession was somewhat insulated compared to many other sectors, largely due to the resilient nature of the pet care industry. While consumers might have cut back on discretionary spending, spending on pet health care remained relatively steady.

Key Factors During the Recession:

- Resilience of Pet Care Industry: Even during the recession, VCA benefited from the fact that pet care is a necessity for many pet owners. Veterinary care and diagnostics are often seen as essential services, with many pet owners willing to spend on their animals’ health even in difficult economic times. The rise of pet insurance also contributed to more predictable revenue streams.

- Stock Volatility: Like many stocks during the financial crisis, VCA's stock saw volatility. The company’s stock price fell during the market turmoil but recovered faster than many other industries, driven by its stable revenue model.

- High Debt: VCA’s high debt levels, primarily from acquisitions, became a concern during the recession. High leverage made the company more vulnerable to any potential cash flow disruptions, and investors grew cautious about its ability to manage debt during a period of economic uncertainty. Nevertheless, VCA’s debt was largely tied to long-term growth plans, and the company’s focus on generating cash flow through existing operations helped mitigate concerns.

Post-Great Recession (2010-2017)

After the Great Recession, VCA stock performed strongly, benefiting from a combination of factors: the recovery of the economy, continued growth in the pet care industry, and VCA’s successful execution of its growth strategy. The post-recession period saw pet ownership continue to grow, with pet care spending reaching new heights, further solidifying VCA's market position.

Key Factors After the Recession:

- Industry Growth: As the economy recovered, consumer confidence returned, and pet owners once again increased spending on veterinary care. In particular, spending on advanced diagnostic and medical procedures, which VCA specialized in, grew steadily. The overall pet care market continued to expand, helping to drive revenue growth for VCA.

- Same-Store Sales Growth: VCA consistently posted positive same-store sales growth in the post-recession years, averaging between 5% and 7% annually, driven by both organic growth and acquisitions. This was a key driver of stock performance.

- Expansion Strategy: VCA continued its strategy of acquiring veterinary hospitals at an aggressive pace, growing its network to include more than 800 hospitals by 2017. The company’s ability to improve margins quickly after acquiring hospitals contributed to higher profitability and stock price appreciation.

- Strong Financial Performance: VCA posted strong revenue and earnings growth throughout the post-recession period, and investors rewarded the company with a steadily increasing stock price. Free cash flow remained strong, allowing VCA to continue its acquisition strategy without taking on excessive additional debt. This helped to ease investor concerns from the recession period and further fueled stock performance.

- Mars Acquisition (2017): By the time VCA was acquired by Mars, Inc. in 2017, the stock had performed exceptionally well. The stock price had increased significantly in the years leading up to the acquisition, rewarding investors who had held onto the stock. The acquisition offer, which was a premium over the trading price, reflected the strong market position VCA had built, especially in the veterinary services and diagnostic sectors.

Stock Performance Summary

Before the Great Recession, VCA's stock price was on a growth trajectory, fueled by acquisitions and expanding demand for veterinary services. During the recession, the company was somewhat insulated from the broader economic decline, but its stock did experience volatility due to concerns over high debt levels. After the recession, VCA’s stock performed strongly, driven by robust demand for pet care services, strong same-store sales growth, and a well-executed acquisition strategy. The stock’s final performance spike came with the acquisition offer from Mars in 2017, which ended the company’s run as a publicly traded entity. The stock rewarded long-term investors and reflected the company’s solid execution in a growing market.