Case studies

Morningstar’s Edge: The Brand That Redefined Mutual Fund Research

Dec 2024

Morningstar was founded in 1984 by Joe Mansueto with the goal of providing more accessible and transparent mutual fund research. Its first major product, the Morningstar Mutual Fund Star Rating system, revolutionized fund evaluation by offering a simple way to compare mutual funds based on past performance adjusted for risk. Initially, the company operated as a small, data-driven publisher, expanding from print to financial software and web-based platforms. Over time, Morningstar grew rapidly, expanding its research offerings to include stocks, bonds, and alternative investments.

By the late 1990s, Morningstar had established itself as a trusted leader in investment research. Its proprietary tools, including the Star Ratings and Analyst Ratings, became industry standards, attracting both individual and institutional investors. The company expanded further through strategic acquisitions, such as Sustainalytics for ESG research and PitchBook for private market data. Morningstar went public in 2005, marking its transition into a global investment research powerhouse.

Morningstar’s reputation for delivering independent, high-quality insights made it the default choice for mutual fund analysis among retail investors, financial advisors, and institutions. Tools like the Morningstar Star Ratings simplified fund evaluation, creating a trusted, transparent way to compare performance and solidifying its role as a go-to resource.

This strong brand foundation enabled Morningstar to adapt and thrive through innovation and diversification. By focusing on transparency, independence, and quality, the company built deep trust with investors. Its blend of proprietary research, user-friendly tools, and strategic acquisitions allowed it to expand into adjacent areas. This combination of data-driven analysis and human expertise sets Morningstar apart from competitors who rely solely on quantitative tools.

In an increasingly complex investment landscape, Morningstar’s ability to simplify decision-making has become even more valuable. Its credibility and accessibility help investors cut through information overload while its adoption by financial advisors for reporting and portfolio construction further embeds the brand into the financial ecosystem. This deep integration across markets and investor segments positions Morningstar to maintain its leadership and continue building on its mutual fund research dominance.

Today the company is more diverse:

· Morningstar Data and Analytics: 34.8% of revenue

· PitchBook: approximately 27.5% of the company’s total revenue.

· Morningstar Credit: 12.4% of revenue

· Other Businesses: The remainder is spread across smaller segments, such as Morningstar Indexes and investment management services

Recurring revenue model

In Q3 2024 Morningstar had a diverse revenue based that was strongly rooted in subscription and recurring type revenue. Approximately 79% of Morningstar’s total revenue is recurring, driven by its subscription products and services like PitchBook, Morningstar Direct, and other data and research platforms. These offerings primarily target financial advisors, institutional clients, and retail investors who rely on continuous access to high-quality investment research and analytics.

This subscription model has been a cornerstone of Morningstar's financial stability and growth, as it ensures predictable income streams and fosters customer loyalty. Recurring revenue segments include its flagship research platforms, investment management solutions, and proprietary data services. The high proportion of recurring income highlights the strong demand and dependence on Morningstar’s tools across the investment industry,

Competitive Position

Morningstar has leveraged its key strategic strengths to grow and become a stronger force in the investment research industry. Examining this through the lens of the Five Forces, Morningstar’s evolution demonstrates how its strategic choices and market positioning allowed it to solidify its leadership over time.

Stock Performance

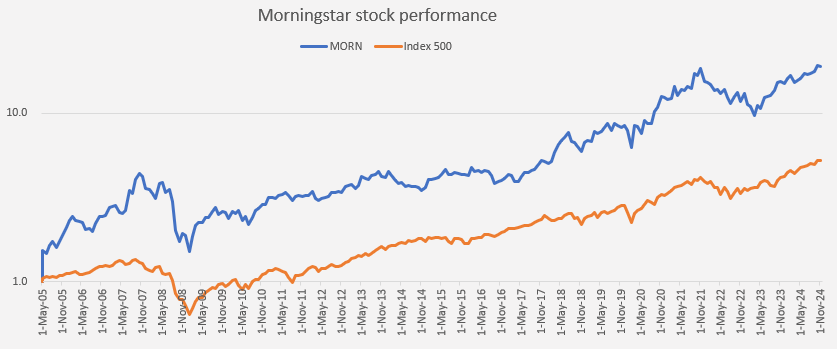

As depicted in the chart above Morningstar's stock performance (MORN) has demonstrated distinct performance trends over time, reflecting its organic growth, strategic acquisitions, and evolving market conditions.

Here's a breakdown by significant periods:

2005-2010: IPO and Initial Growth

Morningstar went public in May 2005, with an initial share price of $18.50. Its stock appreciated steadily in its early years, driven by increasing demand for investment research and data services. By 2010, the price had climbed above $50, supported by the expanding popularity of its mutual fund research and growing brand reputation.

2010-2015: Post-Recession Expansion

During this period, Morningstar's stock experienced moderate but consistent growth, riding the wave of economic recovery. Its acquisitions, like the purchase of Realpoint (a credit ratings agency) and Hemscott data assets, contributed to diversified revenue streams, strengthening investor confidence.

2015-2020: Strategic Diversification

Morningstar focused heavily on diversifying into ESG ratings and private equity research, epitomized by its acquisition of Sustainalytics in 2020. This expansion into trending investment areas helped drive significant appreciation. The stock moved from around $80 in 2015 to over $150 by early 2020, outpacing broader market indices.

2020-Present: Pandemic Resilience and Private Markets Push

The stock gained momentum during the pandemic as digital financial tools surged in demand. The acquisition of PitchBook, which expanded Morningstar's private equity data capabilities, played a pivotal role in driving investor optimism. Shares hit new highs, surpassing $300 in 2021 and peaking at $350 by late 2023. In 2024, the stock has traded between $213 and $330, reflecting market volatility but maintaining robust long-term gains.

Overall Performance

Since its IPO, Morningstar has delivered substantial returns, with its share price increasing nearly 19-fold by 2024 for an annualized return of 17% compared to the overall market annualized return of 9%. This performance highlights the company's strong brand, market adaptability, and ability to capitalize on investment trends like ESG and private markets

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in Morningstar, Inc. (MORN). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.

Organic Growth

Morningstar's organic growth has been driven by a combination of strategic strengths and market trends across its key business segments:

Product Expansion and Client Base Growth: Significant contributions come from Morningstar Data and PitchBook. Morningstar Data experienced organic growth driven by demand for its investment data, particularly managed fund data, and tools like Morningstar Direct. Similarly, PitchBook’s growth is fueled by increasing licensed users in venture capital, private equity, and investment banks, reflecting its popularity in private market research

Recurring Revenue Streams: The company’s subscription-based services, including Morningstar Direct and PitchBook, provide consistent growth by maintaining and expanding their client base. The high loyalty among retail and institutional users ensures a steady revenue inflow from existing subscribers

ESG and Wealth Platforms: Growth in ESG-related offerings (via acquisitions like Sustainalytics) and international wealth management platforms also bolsters organic growth. Increased adoption of investment model portfolios and strategies in these areas highlights Morningstar's ability to capture evolving market demands

Global Reach and Diversification: Expanding its geographic footprint, particularly in Europe, and offering diversified financial solutions beyond mutual funds, such as credit ratings and private market analytics, have helped Morningstar remain resilient and relevant across varied economic conditions

These drivers not only highlight the strength of Morningstar’s brand and trusted reputation but also reflect the company’s ability to adapt and innovate in response to changing investor needs and industry trends.

- 2023: Organic revenue grew by 8.98%, reaching $2.04 billion, supported by strength in key offerings like Sustainalytics, Morningstar Direct, and DBRS Morningstar, despite some softness in ESG demand

- 2022: Organic revenue grew by 10.08%, achieving $1.87 billion. This growth was partly driven by ongoing integration of acquisitions and increased demand for data and analytics solutions

- 2021: The company achieved a higher organic growth rate of 22.3%, reflecting a rebound from earlier pandemic disruptions and strong expansion in Sustainalytics and PitchBook

- 2020: Revenue grew by 17.85%, reaching $1.39 billion. This growth reflected increased demand for its flagship products like Morningstar Direct and significant expansion in ESG analytics through Sustainalytics, which was fully acquired in 2020.

- 2019: Revenue rose by 15.6%, hitting $1.18 billion. Growth was driven by higher adoption of PitchBook and continued expansion of subscription services.

- 2018: Revenue growth was slightly lower at around 13% (estimated), largely due to sustained adoption of investment tools and the early traction of ESG products.

- 2017: Revenue increased by 14% (estimated), reflecting the company’s strategic focus on data-intensive services and deeper penetration of the advisor and institutional markets.

- 2016: Revenue grew by approximately 11%, supported by expanding international operations and the scaling of new digital offerings.

- 2015 and Earlier: Revenue growth ranged between 9-12% annually, with steady adoption of its independent research and portfolio management tools.

Strong Margin Profile

Morningstar has consistently demonstrated strong margins, reflecting its efficient business model and ability to deliver high-value products. Its gross profit margin stands out, typically hovering around 60%, showcasing the scalability of its offerings and the low incremental cost of delivering research and data services. Unlike many companies, Morningstar includes compensation for employees involved in product delivery and proprietary dataset development in its gross margin calculation—highlighting its significant investment in quality.

The company's operating margin has also improved over time, reaching 11.3% in 2023, with an adjusted operating margin of 16%. This improvement reflects greater operational efficiency, despite ongoing investments in growth areas like ESG ratings, private market data, and wealth management tools.

While strategic investments occasionally put pressure on margins, Morningstar’s recurring, subscription-driven revenue streams and its strong brand enable it to maintain solid profitability. Its ability to leverage proprietary research and scalable platforms allows for sustained gross margins, reinforcing the company's long-term financial strength.

Threat of New Entrants

Morningstar’s reputation for trust and transparency has been a cornerstone since its founding in 1984. From the beginning, Joe Mansueto aimed to democratize mutual fund research, offering insights that were previously inaccessible to individual investors. Early innovations like the Morningstar Star Ratings created a significant barrier to entry by establishing a proprietary system that became an industry standard. Over time, Morningstar expanded its portfolio of research products, reinforcing its position and making it difficult for new entrants to compete on depth, breadth, and brand trust.

Additionally, as the company expanded into complementary areas like ESG research (via Sustainalytics) and private market data (via PitchBook), it further insulated itself from threats by diversifying its offerings and deepening its expertise in niche areas. These moves demonstrated Morningstar’s ability to anticipate market trends and raise barriers to entry by offering highly differentiated products.

Bargaining Power of Suppliers

Morningstar’s historical reliance on publicly available data has been a significant strength, allowing it to sidestep dependency on costly third-party suppliers. Early on, this autonomy gave it control over its content production while keeping costs low. As the company grew, it supplemented public data with proprietary methodologies and internal research, creating unique insights that competitors struggled to replicate. For instance, the Morningstar Analyst Ratings, introduced in 2011, built on the company’s legacy of forward-looking research, reinforcing its independence and competitive edge.

Bargaining Power of Buyers

Morningstar has long catered to a diverse client base, including retail investors, financial advisors, and institutional clients. Its ability to offer tools for both casual users and professionals helped it maintain strong customer loyalty despite evolving market pressures. This loyalty was further reinforced by its transparency and emphasis on independent, unbiased research, a hallmark of the company since its inception.

As the company grew, it strengthened its institutional business, particularly with tools like Morningstar Direct and PitchBook, which became essential for wealth managers, private equity firms, and other professionals. Despite the bargaining power of large institutional clients, Morningstar consistently delivered value through a combination of high-quality products and a trusted brand, ensuring that price negotiations did not erode its competitive position.

Threat of Substitutes

The threat of substitutes has always been high for Morningstar, with competition from free or low-cost alternatives, such as Yahoo Finance, Google Finance, and robo-advisors. In the face of this, Morningstar successfully leaned on its qualitative strengths to differentiate itself. The Morningstar Analyst Ratings and Star Ratings, combined with its in-depth reports, offered something free tools could not: expert-driven, forward-looking insights.

Historically, Morningstar has also navigated substitution threats by expanding its ecosystem. Its acquisitions, such as Sustainalytics and PitchBook, allowed it to offer unique research in ESG and private markets, areas where free tools and substitutes remain underdeveloped. These strategic moves not only reduced substitution risk but also created entirely new revenue streams.

Industry Rivalry

Competition in the investment research space has always been intense, with players like Bloomberg, FactSet, and S&P Global posing significant challenges. However, Morningstar differentiated itself by focusing on mutual funds and retail investors, an underserved market at the time of its founding. This focus allowed it to carve out a niche that its larger competitors were not prioritizing.

Over the years, Morningstar’s strategic acquisitions strengthened its position in other competitive areas. For example, PitchBook helped it tap into private market data, while Sustainalytics positioned it as a leader in ESG research. By building expertise in these areas, Morningstar not only diversified beyond mutual funds but also competed effectively in spaces where rivals had less dominance.