Case studies

Chipotle: Where ‘Food with Integrity’ Meets Business Excellence

Dec 2024

Company Overview and History

Chipotle Mexican Grill, Inc. (NYSE: CMG) was founded in 1993 by Steve Ells in Denver, Colorado. From the very start, the company set itself apart with its "Food with Integrity" philosophy. Unlike traditional fast-food chains, Chipotle introduced a fast-casual dining experience that combined high-quality, sustainably sourced ingredients with quick service. This unique approach tapped into growing consumer demand for fresh, healthier food options.

The company started with just one store but grew quickly. In 1998, McDonald’s Corporation invested in Chipotle, providing the resources to accelerate its expansion. By 2006, Chipotle went public with an IPO that raised $173 million (trading under the ticker CMG). At that time, Chipotle already had 1,000 stores in the U.S. and ambitions for global growth. In 2010, it opened its first European store in London, further expanding its footprint.

Fast forward to today, Chipotle operates over 3,400 stores worldwide and has become one of the largest players in the fast-casual dining sector. The company’s market cap now exceeds $70 billion, reflecting its strong brand, consistent growth, and operational excellence.

Five Forces Analyss

Stock Performance

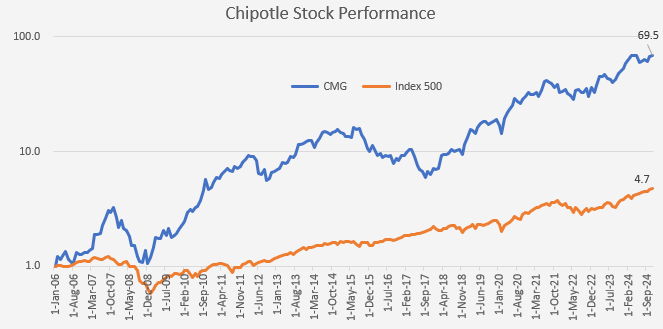

As depicted in the chart above Chipotle's stock performance (CMG) since 2006 tells a compelling growth story

Here's a breakdown by significant periods:

IPO to 2015: After debuting at $22 per share in Nov 2006, the stock doubled on its first trading day, closing at $44. From there, it experienced consistent gains, reflecting the company’s rapid expansion and success in building a strong brand. By 2015, Chipotle’s stock reached $750, powered by strong same-store sales growth and excellent unit economics.

2015-2017: The food safety crisis in late 2015 marked a turning point, causing the stock to plummet below $300. Concerns over reputational damage and falling sales led to a period of underperformance.

2018 to Present: Chipotle rebounded under the leadership of Brian Niccol, who focused on revitalizing the brand through digital initiatives, menu innovation, and operational improvements. Since then, the stock has grown consistently, surpassing $3,000 per share by 2024. A 50-1 stock split was conducted in June 2024.

Overall Performance: Investors who purchased the stock shortly after its IPO would have been richly rewarded as the stock appreciated nearly 70x since the end of November 2006 for an annualized return of 25%. The compares to the broader market which appreciated almost 5x for an annualized return of 9% during the same time period.

This trajectory reflects Chipotle’s ability to overcome challenges, innovate, and capitalize on its growth potential. The company's consistent focus on improving store-level economics, driving organic growth, and expanding its footprint has translated into long-term shareholder value.

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in Chipotle. (CMG). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.

Store-Level Economics

Chipotle’s store-level economics are among the best in the restaurant industry, driven by high returns on investment and operational efficiency. Compared to competitors like Qdoba and Moe’s Southwest Grill, Chipotle’s stores consistently outperform with higher Average Unit Volumes (AUVs), greater margins, and faster payback periods. This relative strength highlights the company’s operational discipline and the enduring appeal of its brand.

Capital Costs:

The typical cost to build and open a new Chipotle restaurant ranges between $800,000 to $1.2 million, depending on location and store format. Chipotle has also introduced Chipotlane drive-thru stores, which require slightly higher upfront capital but provide enhanced long-term sales potential.

Mature Store-Level Margins:

Once a Chipotle restaurant reaches maturity (typically 1-2 years), store-level margins consistently exceed 25%. This strong profitability is driven by a combination of factors:

- High Average Unit Volumes (AUVs): Chipotle’s AUVs have climbed to approximately $3 million per store in recent years, reflecting strong demand and pricing power.

- Lean Labor Costs: The operational model, which emphasizes fast-casual service, keeps labor expenses manageable relative to full-service restaurants.

- Pricing Power: Chipotle’s ability to raise menu prices without losing customers helps offset inflationary pressures.

- Efficient Food Costs: While Chipotle sources premium ingredients, its focused menu minimizes waste and simplifies inventory management.

With capital costs of roughly $1 million and mature store-level margins of 25%, a new Chipotle store can generate $750,000 in annual operating profit on $3 million in revenue, delivering a payback period of 1.5-2 years. This results in an ROIC (Return on Invested Capital) of approximately 70-80%, among the highest in the industry.

Sales Per Store Over Time

Over time, Chipotle’s sales per store—measured as Average Unit Volumes (AUVs)—have consistently increased, reflecting the company's ability to drive traffic, raise prices, and optimize operations:

- 2006 (IPO Year): AUVs were approximately $1.3 million, driven by initial excitement and rapid store openings.

- 2010: AUVs rose to $1.5 million, showcasing steady growth as the brand matured.

- 2015: AUVs climbed to $2.5 million, reflecting growing brand strength and pricing power.

- 2016-2017: AUVs dipped below $2 million during the food safety crisis.

- 2018-2023: AUVs rebounded to over $3 million per store due to:

- Digital Sales: Contributing over 40% of revenue, driving incremental sales.

- Chipotlane Expansion: Stores with Chipotlanes report 10-15% higher AUVs.

- Menu Price Increases: Offsetting inflation while maintaining demand.

- Operational Efficiencies: Allowing stores to serve more customers and improve throughput.

With $3 million in AUVs, Chipotle has established one of the most attractive unit economic models in the restaurant industry, demonstrating how well its concept can scale and perform over time. Compared to competitors like Qdoba (AUVs around $1.5 million) and Moe’s Southwest Grill ($1.1 million), Chipotle’s unit economics are unmatched.

Replicability and Long-Term Growth Potential

The strength of Chipotle’s investment thesis lies in the ability to replicate its store model thousands of times. Each store is profitable, scalable, and requires relatively low upfront capital. The model works well because it combines:

- A simple, efficient operational structure.

- Strong unit economics with high ROIC.

- Broad consumer demand for its differentiated food quality.

Chipotle’s long-term plan to reach 7,000 stores in North America is realistic, given its current store count of ~3,400 and continued strong performance. The company has projected a consistent annual growth rate of approximately 8%, which positions it to hit the target by the early 2030s. This expansion timeline reflects Chipotle's confidence in the replicability of its store model and its ability to sustain strong unit economics across diverse markets.

International Growth Potential

While Chipotle has been wildly successful in the U.S., its international expansion remains in the early stages. The company operates a small number of locations in Canada, the U.K., and Europe. The key question is: Can Chipotle replicate its success internationally?

Opportunities:

- Chipotle’s focus on fresh, high-quality food aligns with global trends toward healthier eating.

- Its operational model is simple, scalable, and transferable across markets.

- Rising middle-class populations in Europe and Asia present strong demand for premium fast-casual options.

Challenges:

- Differing tastes and preferences in international markets may require menu adjustments.

- High real estate and labor costs in markets like Europe can impact margins.

- Brand awareness outside the U.S. is still limited, requiring significant marketing investments.

That said, if Chipotle can adapt its model effectively, there’s potential for thousands of additional stores globally. Analysts estimate that Chipotle’s total international market opportunity could approach 2,000-3,000 stores, bringing its total long-term potential store count to 10,000+ locations.

Financial Model and Performance

Chipotle’s financial performance has been a standout in the restaurant industry, driven by strong organic growth and impressive margins.

Revenue Growth:

The company’s organic growth strategy focuses on same-store sales growth and consistent new store openings, with a particular emphasis on leveraging digital sales channels and the expanding presence of Chipotlanes. Digital sales, which now contribute over 40% of revenue, play a significant role in driving incremental growth by enhancing convenience and customer loyalty. Chipotlanes, meanwhile, have proven to be a major growth driver, with stores featuring this format generating 10-15% higher average unit volumes (AUVs) compared to traditional locations. From 2018 to 2023, Chipotle achieved a 14% compound annual growth rate (CAGR) in revenue.

Company level Margins:

Chipotle’s company-level margins highlight its efficiency and profitability, which are critical to its valuation and growth potential. Key components include:

Restaurant-Level Operating Margins:

Chipotle’s restaurant-level operating margins (gross margins for store operations) are among the highest in the fast-casual dining industry. Historically, margins hovered between 22-24% in the mid-2010s, peaking before the food safety incidents. After recovering from the 2015-2017 crisis, margins have improved steadily, exceeding 25% in recent years, even with rising labor and food costs. This success is attributed to pricing power, higher AUVs, and efficiencies from digital and Chipotlanes.

Operating Margins (Company-Wide):

At the corporate level, operating margins reflect the impact of general and administrative (G&A) expenses, marketing, and other overhead. Pre-crisis (2015), operating margins reached 17-18%, highlighting how well Chipotle leveraged its scale. Post-crisis, these dipped to single digits but rebounded strongly, climbing back to approximately 15% by 2023.

Net Profit Margins:

Chipotle’s net margins (bottom line) have consistently improved, reflecting disciplined cost management and the high profitability of its store base. Net margins averaged 9-10% before the food safety crisis. As of 2023, net margins are nearing 12-13%, supported by operational efficiencies and revenue growth.

Comparison to Competitors

Chipotle’s margins are significantly higher than those of its fast-casual competitors. For example:

- Qdoba: Restaurant-level margins typically range around 18-20%, with lower AUVs and higher labor costs impacting profitability.

- Moe’s Southwest Grill: Margins are often below 15-18%, reflecting smaller scale and weaker brand loyalty.

- Panera Bread: While competitive on operating margins, Panera has higher input costs and less pricing power compared to Chipotle.

These comparisons underscore how Chipotle’s streamlined operations and premium positioning allow it to outperform competitors.

Why Margins Matter for Investors

- Scalability:

Chipotle’s high margins at both store and company levels demonstrate the scalability of its model. With each store delivering a robust return on investment, Chipotle can fund expansion while maintaining profitability. - Defensive Pricing Power:

Even during periods of inflation, Chipotle has maintained or expanded margins, leveraging its ability to pass costs onto consumers without significant demand loss. - Future Growth Potential:

Strong margins provide flexibility to invest in strategic initiatives like international expansion, digital innovation, and Chipotlanes, setting the stage for sustainable growth.

Chipotle operates in a competitive and dynamic industry, but its unique value proposition gives it an edge. Beyond its commitment to food quality, Chipotle differentiates itself through exceptional customer loyalty, bolstered by its Chipotle Rewards program, which has over 30 million members. The company also leverages technology to enhance the customer experience, with innovations like digital ordering, app-based rewards, and the highly efficient "Chipotlane" drive-thru format. These elements not only strengthen the brand but also streamline operations, further distancing Chipotle from competitors in the fast-casual dining sector. Here’s how Porter’s Five Forces shape its business:

Threat of New Entrants: Moderate

It’s relatively easy to enter the restaurant industry, given the low capital requirements. However, Chipotle’s scale, brand recognition, and established supplier relationships make it difficult for new players to replicate its success. While small local competitors might emerge, achieving Chipotle’s economies of scale and quality standards is a tall order.

Bargaining Power of Suppliers: Moderate

Chipotle’s commitment to natural, organic, and sustainably sourced ingredients means it relies on specialized suppliers. To mitigate risks associated with this dependency, the company has implemented several strategies, including diversifying its supplier base and exploring vertical integration. By cultivating long-term relationships with multiple suppliers and investing in supply chain initiatives, Chipotle ensures stability and reduces the impact of potential shortages. This focus can limit options, but Chipotle has mitigated supplier power through long-term relationships and its growing scale. That said, periodic supply shortages, particularly with natural chicken or organic produce, can pose risks.

Bargaining Power of Customers: Low to Moderate

Customers appreciate Chipotle’s premium food quality, transparency, and customization, which fosters strong loyalty. While consumers remain price-sensitive, Chipotle’s brand strength allows it to raise prices without significant pushback.

Threat of Substitutes: High

Home-cooked meals, fast food, and other fast-casual restaurants all serve as substitutes. However, Chipotle counters this threat by offering fresh, customizable, and healthy meals at reasonable prices. Its value proposition stands out compared to traditional fast food.

Industry Rivalry: High

The fast-casual market is fiercely competitive, with players like Qdoba, Moe’s Southwest Grill, and Panera Bread. Chipotle’s differentiation comes from its focus on quality, transparency, and its strong operational performance. While competitors might mimic its model, Chipotle’s brand and store-level economics provide a significant advantage.