Case studies

Airgas- The Strategy That Built a $13B Giant

December 2024

Airgas was founded in 1982 by Peter McCausland, a lawyer with deep expertise in the industrial gases industry. From the beginning, McCausland had a clear vision: consolidate the fragmented U.S. market of regional gas suppliers into a cohesive national network. His leadership and strategic insight as a founder were instrumental in driving Airgas’s success.

The company grew rapidly through an aggressive acquisition strategy, acquiring over 400 smaller companies to build an extensive footprint across the country. This strategy not only expanded its market share but also allowed Airgas to achieve route density—a key operational advantage that optimized delivery logistics and reduced costs. Its ability to offer fast, reliable service at scale set it apart from smaller regional competitors, who often couldn’t match its efficiency or breadth of offerings.

As a founder-led company, Airgas benefited from McCausland’s long-term thinking and hands-on leadership. His deep industry knowledge and personal stake in the business drove bold decisions that professional managers might have avoided. For instance, McCausland balanced Airgas’s national scale with a strong local service ethos, ensuring customers received the personalized care they expected while benefiting from the resources of a larger organization. This hybrid model was a key differentiator in the competitive industrial gas market.

Competitive Environment

Airgas operated in a highly competitive landscape, facing both large multinational rivals like Linde (formerly Praxair) and Air Products, as well as smaller regional players. Unlike the global giants, which focused heavily on bulk and tonnage gases for massive industrial clients, Airgas built its niche by serving small and medium-sized businesses (SMBs), as well as industries like healthcare, food and beverage, and manufacturing. Its ability to combine national scale with localized service made it stand out.

Smaller regional competitors often tried to compete on price, but Airgas’s broader product offering—including welding equipment, safety supplies, and specialty gases—gave it a major advantage. Customers valued the convenience of a one-stop shop, as well as the reliability of Airgas’s extensive distribution network.

Bargaining Power

- With Customers: Airgas’s customer base was diverse, ranging from small businesses to larger regional industries. Its scale and reliability gave it strong bargaining power, especially in industries where continuity of supply was critical, like healthcare or food production. Customers often had limited alternatives, particularly in regions where Airgas had consolidated smaller competitors. In addition, gas is a relatively low cost, but important product to most of its customers.

- With Suppliers: Airgas also benefited from strong bargaining power with suppliers. By consolidating purchases across its vast network, it could negotiate better prices for gases, cylinders, and equipment. This allowed it to maintain competitive pricing while protecting its margins—a key advantage over smaller rivals.

Threat of New Entrants

The threat of new entrants in the industrial gases market was relatively low, due to significant barriers to entry:

- Capital Requirements: Building a network of gas production facilities, distribution centers, and delivery routes required substantial investment.

- Regulatory Hurdles: The handling and transportation of gases required compliance with strict safety and environmental regulations, making it hard for new players to enter the market.

- Established Relationships: Airgas’s strong customer relationships and brand reputation made it difficult for newcomers to lure clients away.

Substitute Products

While industrial gases have few direct substitutes, some industries could use alternative technologies to reduce dependence on traditional gases. For example:

- Manufacturing processes might move toward less gas-intensive methods.

- In welding, advances in technology could reduce demand for traditional shielding gases. However, these changes were incremental and did not pose an immediate threat to Airgas’s core markets.

Airgas’s Position

By the time it was acquired, Airgas had established itself as a dominant player in the U.S., with a competitive edge rooted in:

- Route Density: Its efficient delivery model reduced costs and allowed it to serve customers quickly and reliably.

- Broad Product Mix: Beyond gases, Airgas offered complementary products and services, giving it multiple revenue streams.

- Customer Loyalty: Its combination of national scale and local service created deep customer relationships, particularly in industries where reliability and frequent deliveries were non-negotiable.

- Operational Efficiency: Consolidating acquisitions allowed Airgas to achieve economies of scale that smaller competitors couldn’t match.

Overall, Airgas thrived by leveraging its size and expertise to outcompete both global giants in niche markets and smaller rivals in scale-sensitive operations. This strategic balance of efficiency, breadth, and local focus made it a formidable player in the U.S. industrial gas market.

Robust Financial Model

What made Airgas stand out was the nature of its products and customer relationships. The industrial gases Airgas supplied were a low-cost yet critical component of its customers' operations, spanning industries like healthcare, manufacturing, food services, and energy. This importance, combined with the diversity of Airgas's business—geographically, by customer type, and across its millions of customers—enabled the company to achieve highly recurring revenues. These revenues were supported by strong customer loyalty and consistent demand for its products.

Airgas’s business model was inherently predictable. The company delivered mid- to high-single-digit organic growth through a combination of price increases and volume expansion. This steady, reliable growth, along with its relatively low-to-mid return on equity (ROE), made Airgas well-suited for the strategic use of leverage. Financial models frequently identified the business's predictable cash flows and low volatility, allowing Airgas to take on moderate levels of debt to fund acquisitions and operations effectively.

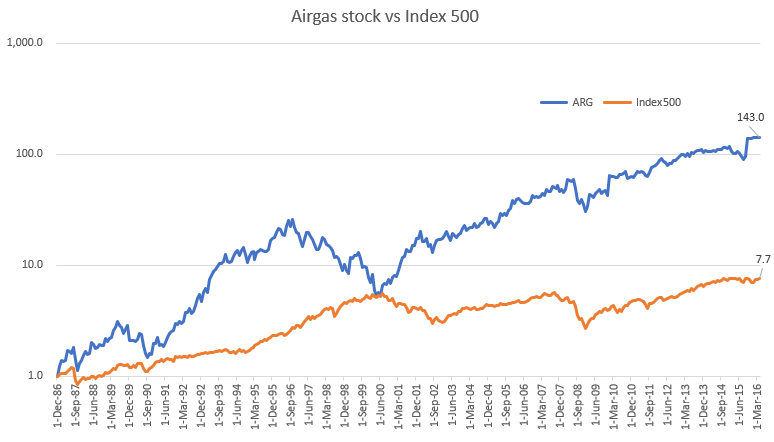

Airgas stock reflected the growth in the business

Airgas's stock performance over the years reflected its growth and success in consolidating the fragmented industrial gas market. Before its acquisition by Air Liquide in 2016, Airgas experienced strong growth, driven by both its aggressive acquisition strategy and its ability to deliver consistent results in a competitive industry.

Here’s an overview of how Airgas performed in the stock market leading up to its acquisition:

Growth Through the 90s

- Stock Price and Market Performance: Airgas's stock performed extremely well during the 90s as investors appreciated the strong growth and consistency of Airgas's business. The stock corrected materially in the late 90s as investors shifted their attention to internet related stocks.

- Growth in the U.S. Industrial Gas Market: As Airgas expanded its reach across the U.S. and diversified its product offerings, it built strong momentum, which was reflected in its stock price. The company’s consistent growth and its position as the largest distributor of industrial gases in the U.S. helped it maintain a relatively stable and upward trajectory.

Growth Through the 2000s and Early 2010s

- Stock Price and Market Performance: Airgas's stock generally performed well through the 2000s and into the 2010s. The company’s strategy of acquiring smaller regional gas distributors and focusing on operational efficiency helped boost investor confidence. Airgas had a solid reputation for delivering steady revenue and profit growth, particularly in its niche markets.

- Increased Valuation: By the time Air Liquide made its $13.4 billion offer in 2015, Airgas had reached a significant market valuation, with its stock hovering around the $140–$150 range in the months leading up to the acquisition. At this point, investors saw Airgas as a leader in the industrial gas sector, with a well-established track record of growth through acquisitions and operational optimization.

- Stock Response to Acquisition Offer: Once the acquisition offer from Air Liquide was announced, Airgas’s stock price surged to align with the terms of the deal. The acquisition was priced at $143 per share in cash, which represented a premium to its pre-announcement price. Investors responded positively to the deal, knowing that it represented a significant payout for Airgas shareholders.

Performance Compared to Competitors

Airgas’s stock generally outperformed some of its larger competitors in the U.S. industrial gases sector during the years leading up to its acquisition. While competitors like Air Products and Linde had strong performances, Airgas’s more focused approach on SMBs, its efficient operations, and its expansion strategy provided it with strong investor confidence. Moreover, Airgas’s ability to generate steady cash flows, thanks to its diversified product base, allowed it to command a higher valuation.

Cumulative Stock Return for Investors

Investors who held Airgas stock during the years leading up to the acquisition likely saw solid returns. By the time of the acquisition in 2016, the stock had appreciated considerably, benefiting from the strategic direction McCausland and his team implemented. The logarithmic chart below shows the extent of Airgas stock performance, growing 143x over a 30 year stretch from 1986 compared to less than 8x for the broader market. This represents an annualized stock return of 18% compared to the market return of 7%.

.

Post-Acquisition

After Airgas was acquired by Air Liquide in 2016, its stock was delisted, and investors received the agreed-upon $143 per share in cash. The acquisition allowed shareholders to realize the full value of their investment at a premium, reflecting the success McCausland had achieved in growing the company.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.