Outlook 2025: Small Caps, AI, and the Valuation Dilemma -Jan 2025

The 2024 Market Recap: A Tale of Two Markets

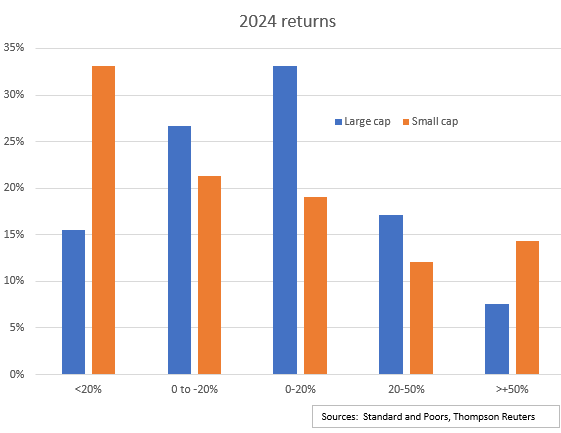

The 2024 market was dominated by the Magnificent 7—a group of mega-cap stocks that soared 44% on average, driving most of the S&P 500’s® gains. Meanwhile, the rest of the S&P 500 managed just a 10% return, highlighting the extreme concentration of market leadership. Despite the S&P 500 Index’s strong return of 23%, the vast majority, or 75%, of stocks underperformed the Index. The struggle was more pronounced with Smallcaps, with 54% posting negative returns and 74% underperforming the S&P 500.

Small-cap performance was especially challenging, as rising interest rates and economic uncertainty disproportionately impacted these smaller companies. While large caps benefited from their global scale and AI-driven narratives, small caps often faced headwinds like tighter financing conditions and reduced investor appetite for risk. Despite their underperformance, this dynamic may set up small caps for a potential rebound as investors look for value in overlooked areas of the market.

To put this in perspective, the combined value of the smallest 2,000 stocks in the Russell 3000 Index® as of year-end 2024 was $3.2 trillion—smaller than the valuation of Apple (AAPL) stock alone, which stood at $3.7 trillion. This staggering contrast underscores the extreme concentration of market wealth and highlights the challenges facing small-cap companies.

Valuations and Historical Returns: A Warning Sign

Adding to the complexity, valuations across the board are elevated. Large-cap stocks are trading at 21.5x earnings, well above their 30-year historical average of 15.9x. Small caps, despite underperformance, are valued at 24.2x earnings, exceeding their historical average of 21.5x. Outside the COVID era, the last time valuations reached these levels was during the tech bubble—a sobering comparison.

High valuations often signal caution for investors. Historical analysis from JP Morgan shows that when the S&P 500 trades at these elevated levels, the subsequent five-year returns tend to be lackluster, averaging low single digits. This trend underscores the need for prudence in a market where much of the growth is already priced in.

Adding to the uncertainty are macroeconomic headwinds: increasing credit delinquencies and a yield curve that’s been inverted for years. Both indicators suggest that economic risks could weigh on market performance in the near term.

The January Effect: A Potential Catalyst for Small Caps

Despite these challenges, there’s an opportunity for small caps to shine in early 2025, thanks to the January Effect. Historically, stocks that underperformed in the previous year often see a rebound in January as tax-loss selling subsides and investors look for bargains. With small caps heavily out of favor in 2024, this could set the stage for a rotation into these names.

Moreover, the significant gains in mega-cap stocks could prompt profit-taking, creating additional fuel for a shift toward smaller, undervalued names. This rotation aligns with the valuation disparity and the broader historical tendency for small caps to lead during recovery periods.

AI: A Long-Term Theme with Opportunities Beyond Mega-Caps

One of the driving forces behind the Magnificent 7’s success in 2024 was their ability to capitalize on AI opportunities. These companies, with their scale, infrastructure, and data, are uniquely positioned to lead in AI’s development and deployment. However, this trend feels reminiscent of the dot-com bubble—an initial surge of enthusiasm followed by a period of recalibration.

This dynamic also brings to mind the modern “Nifty Fifty” of the 1990s, when large-cap tech companies like Microsoft, Cisco, and Intel dominated the market. Much like today’s Magnificent 7, these companies were seen as the future, commanding high valuations due to their perceived ability to reshape industries. While some of these 1990s leaders thrived in the long term, others struggled to deliver on their lofty promises, especially after the dot-com bubble burst. The lesson is clear: even dominant companies can falter when valuations outpace sustainable growth.

While the mega-caps have captured most of the AI excitement, there are significant opportunities beyond these giants. Derivative plays, such as semiconductor manufacturers, cloud providers, and companies focused on modernizing the electrical grid, are integral to AI’s ecosystem. Additionally, smaller companies working on niche AI applications or overlooked innovations may offer outsized growth potential as the theme matures.

Balancing Caution with Opportunity

The current market environment demands a balanced approach. On one hand, high valuations and macro risks call for caution. On the other, the January Effect and the long-term promise of AI present compelling opportunities. Investors should consider:

- Avoiding Overextended Names: Be wary of chasing the Magnificent 7 at current valuations without strong earnings support.

- Exploring Small Caps: Look for high-quality small-cap stocks poised for a January rebound.

- Tapping into AI’s Ecosystem: Focus on derivative plays and overlooked companies that could benefit from AI’s growth over the coming years.

Conclusion

Current valuations suggest a heightened risk of subpar long-term returns, making selectivity more critical than ever. While 2024 proved challenging for stock pickers due to the concentration of gains in the largest names, 2025 offers opportunities for those willing to dig deeper. Whether it’s uncovering value in small caps, identifying derivative AI plays, or positioning for shifts in macroeconomic conditions, a disciplined and diversified approach will be essential for navigating the year ahead.

Note: One of my favorite resources to find data is the JP Morgan Asset Management Guide to the Markets. If you’re not familiar with their quarterly published guide, you should be. It’s an invaluable tool for understanding market trends and valuations.

Disclaimer:

This note is provided for informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect the views of any affiliated entities. Investors should perform their own due diligence or consult with a financial advisor before making any investment decisions. The specific securities and investments mentioned are discussed solely for illustrative purposes and should not be considered an endorsement or a recommendation to buy or sell any security. The information provided is based on publicly available data as of the date of publication and is subject to change.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.