Case studies

Kmart: The Post Bankruptcy 10-bagger

Dec 2024

Kmart’s post-bankruptcy story is a fascinating example of how a struggling company can seemingly rise from the ashes like a phoenix, offering investors incredible opportunities—if only for a moment. Emerging from bankruptcy in 2003, Kmart was relieved of its crushing debt and had the advantage of valuable real estate, below-market leases, and a clean slate to restructure its operations. With these financial burdens lifted, it had a chance to reinvent itself and chart a new course. Wall Street quickly took notice, fueling excitement and pushing the stock higher on the promise of a brighter future. For a time, it seemed like Kmart had all the tools for a remarkable comeback. But while the rally in its stock created significant wealth for savvy investors, the company’s operational challenges were far from resolved. Despite its long-term viability in question, the stock offered a trading opportunity for savvy investors, albeit a speculative one.

Profiting from Kmart’s post-bankruptcy rally required recognizing it as a “special situation” rather than a long-term investment. The key was understanding that the stock’s rise was driven by financial engineering, like asset sales and cost-cutting, rather than a genuine turnaround in its retail business. Investors needed to focus on specific catalysts such as Eddie Lampert’s leadership, the market excitement around real estate monetization, and the initial optimism about the company’s restructuring. Success in this type of trade relied on discipline—setting clear price targets, monitoring valuation, and being prepared to exit as soon as the hype outweighed the fundamentals.

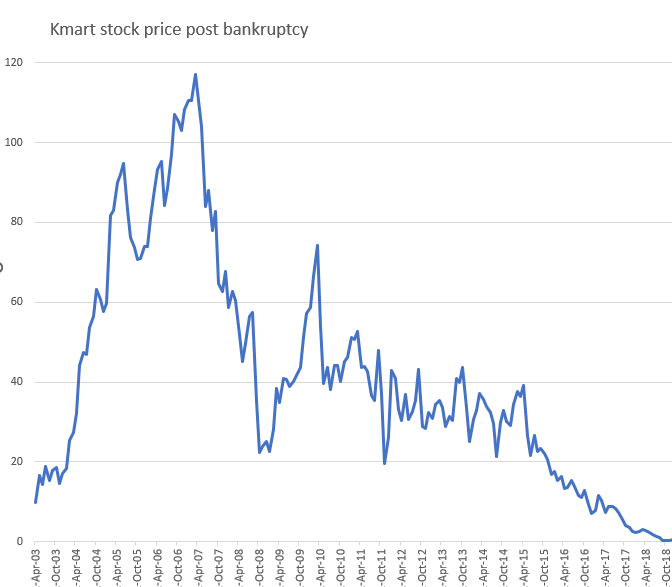

The lesson here is that opportunities like Kmart are inherently short-term plays, not bets on operational recovery. An investor who entered early, capitalized on the momentum, and sold before the cracks in the business became unavoidable could have made substantial gains. However, staying too long—hoping for further upside despite clear weaknesses—would have resulted in being caught in the eventual collapse. Ultimately, trading a special situation like Kmart is about timing, focus, and the discipline to exit once the opportunity has run its course. Below you can see the quick and dramatic rise in Kmart stock post bankruptcy, followed by its inevitable decline.

While at Sunrise Stock Research, we emphasize the importance of long-term investing as the cornerstone of building wealth, we also recognize the ultimate goal: to make money. Sometimes, unique opportunities arise where short-term strategies can deliver outsized gains, provided investors approach them with discipline and a clear understanding of the risks. The post-bankruptcy rise of Kmart is one such case—a compelling example of how strategic investing in special situations can generate remarkable returns, even when the underlying business remains fundamentally flawed.

Profiting from Kmart’s post-bankruptcy rally as a “special situation” investment required a disciplined, tactical approach focused on recognizing the temporary nature of the opportunity and exiting before the inevitable decline. Here’s how an investor might have navigated this scenario:

1. Understand the Nature of the Opportunity

Kmart was a classic special situation—a company emerging from bankruptcy with a unique set of circumstances. The stock’s initial rally wasn’t driven by operational improvements but by financial restructuring and the liquidation of valuable assets like real estate. Investors would need to approach this with the mindset that the opportunity was temporary and speculative, not a long-term turnaround play. The goal would be to capitalize on the hype and strategic moves, not to hold out for an operational revival.

2. Look for Catalysts

Special situation investors would have identified specific catalysts likely to drive short-term gains. For Kmart, these included:

- Asset Sales: Real estate monetization was a clear driver of value.

- Management Moves: Eddie Lampert’s leadership and his reputation as a savvy financier created market optimism.

- Market Sentiment: Investor excitement around the stock’s potential in the early post-bankruptcy period fueled momentum.

Recognizing these catalysts would have helped an investor identify when the stock had room to rise.

3. Monitor Valuation Closely

As Kmart’s stock price climbed, it became increasingly clear that its valuation was disconnected from its retail fundamentals. An astute investor would track the company’s financial metrics, such as cash flow, earnings (or lack thereof), and the diminishing value of its real estate portfolio as assets were sold. Once the valuation stopped making sense relative to these metrics, it would signal a good time to sell.

4. Set Exit Triggers

To avoid being caught in the eventual decline, a disciplined investor would establish clear exit criteria:

- Price Targets: Setting a target price based on a reasonable assessment of how much value could be unlocked from asset sales and cost reductions.

- Time Horizon: Recognizing that the market euphoria around special situations often fades after the initial hype subsides. An investor might plan to exit within 12-24 months after the restructuring.

- Deteriorating Fundamentals: Watching for signs that the company wasn’t making progress toward a sustainable business model, such as continued same-store sales declines or an inability to compete effectively with rivals.

5. Avoid Getting Greedy

The biggest risk in special situations is staying in too long, hoping for additional upside. For Kmart, the warning signs were evident:

- Lack of reinvestment in stores and operations.

- Continued erosion of market share to Walmart, Target, and Amazon.

- Over-reliance on asset sales to generate cash, signaling a lack of future growth prospects.

Exiting as the stock approached inflated valuations would have been critical to locking in profits.

6. Use a Hedging Strategy

To mitigate risk, investors could have used options or other hedging strategies:

- Stop-Loss Orders: Placing stop-loss orders to protect against sudden declines in the stock price.

- Options: Buying put options to profit if the stock turned downward unexpectedly.

This approach would have allowed for participation in the rally while managing downside risk.

7. Focus on Market Sentiment

Kmart’s stock was heavily influenced by investor sentiment rather than operational performance. Paying attention to shifts in market narratives—for example, declining media enthusiasm about Lampert’s strategies or increasing skepticism about the company’s ability to compete—would have provided clues that the window for gains was closing.

The Bottom Line

Special situations like Kmart require a clear strategy and a willingness to act decisively. By focusing on catalysts, tracking valuation, and setting disciplined exit points, investors could have profited from Kmart’s post-bankruptcy rally while avoiding the long-term collapse. The key is to recognize these opportunities for what they are—short-term plays, not sustainable investments—and to trade accordingly.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.