Case studies

The Diabetes Disruptor: How Dexcom Changed the Game

Dec 2024

Dexcom, a pioneer in continuous glucose monitoring (CGM) technology, has become one of the most compelling success stories in healthcare. By 2012, the company was already carving out a dominant position in the diabetes management market, supported by innovation, strategic partnerships, and a razor-and-blade financial model. Today, Dexcom is a market leader but the seeds of its success were sown well before its breakout years. This case study explores Dexcom's evolution, key competitive advantages, financial model, and what investors could have identified early to foresee the company’s potential.

In this case study much of our focus on Dexcom in 2012 stems from the fact that this was the year our models first identified the company as a potential investment opportunity. Prior to this, Dexcom’s market capitalization was too small and the stock too speculative to register in our screening criteria. Once it met our criteria, we conducted in-depth research, identified its strong growth potential, and made our investment.

Diabetes is a Global Epidemic with its prevalence increasing at an alarming rate worldwide. According to the World Helath Organization In 2022, the number of adults living with diabetes surpassed 800 million, more than quadrupling since 1990. This surge is particularly pronounced in low- and middle-income countries, where the prevalence has been rising more rapidly than in high-income nations. Projections indicate that by 2045, approximately 783 million adults aged 20–79 years will be living with diabetes, representing a 46% increase from current numbers. (NCBI). In the US, as of 2021, approximately 38.4 million Americans, or 11.6% of the U.S. population, have diabetes. (American Diabetes Association). Among these individuals, about 7.4 million rely on insulin to manage their condition. (University of South Carolina). Continuous Glucose Monitor's such as the type Dexcom offers have become an important tool in managing diabetes.

The Early Years: Laying the Foundation

Dexcom was founded in 1999 with a clear vision: to revolutionize diabetes care by making blood glucose monitoring easier, more accurate, and continuous. Early on, the company’s focus was on developing CGM systems, which provide real-time glucose data and trends, enabling better management of diabetes compared to traditional finger-stick testing.

However, breaking into this market wasn’t easy. CGM was a nascent technology, and Dexcom faced significant challenges, including FDA approvals, skeptical payers reluctant to reimburse, and patient hesitancy due to the steep upfront costs of the devices. Yet, by 2012, Dexcom had made significant progress:

- It had launched its SEVEN PLUS system, a CGM device with superior accuracy and a 7-day wear period.

- Partnerships with insulin pump manufacturers like Animas, Insulet, and Tandem positioned the company as a key player in integrated diabetes care.

- The next-generation Gen 4 Platinum sensor was on the horizon, promising even better accuracy and ease of use.

Despite these wins, the market was still heavily dominated by Medtronic, which had a 60% share due to its vertically integrated pump and CGM systems. Dexcom, with roughly 30%-35% market share, needed to prove its staying power and innovation to carve out a sustainable competitive advantage.

Strategic Positioning: The Five Forces at Play

Understanding Dexcom’s market position through Michael Porter’s Five Forces framework highlights why the company emerged as a leader:

Rivalry Among Existing Firms:

The CGM market was an oligopoly dominated by Medtronic, Dexcom, and a few smaller players like Abbott. Medtronic’s integrated pump-CGM system gave it an early edge, but Dexcom’s focus on accuracy and longer sensor life helped it differentiate itself. By partnering with major insulin pump manufacturers, Dexcom leveled the playing field, ensuring its technology was widely accessible.

Threat of New Entrants:

Barriers to entry were high due to significant R&D requirements, regulatory hurdles, and the need for clinical validation. While companies like Bayer and smaller startups explored CGM technology, they were years away from launching competitive products in the U.S. market.

Threat of Substitutes:

The primary substitute for CGM systems was traditional finger-stick testing, which, while more accurate at the time, lacked the continuous data and trend analysis that CGMs offered. Dexcom’s focus on demonstrating the clinical benefits of CGM—such as better glucose control and reduced complications—helped position it as a superior solution. Emerging non-invasive glucose monitoring technologies posed a long-term threat but were far from market-ready.

Bargaining Power of Suppliers:

Dexcom relied on single-source suppliers for critical components, such as its application-specific integrated circuits and polymer membranes. This dependency introduced risk, but the company’s ability to scale and negotiate long-term partnerships with these suppliers ensured consistent product delivery.

Bargaining Power of Customers:

In 2012, reimbursement was a significant challenge. Many private insurers had restrictive policies, and CGMs were not yet covered by Medicare. Patients often bore high out-of-pocket costs, limiting adoption. However, Dexcom’s ability to demonstrate the clinical and economic value of CGMs through data and publications helped shift payer attitudes over time.

The Financial Model: A Razor-and-Blade Approach

Dexcom’s business model was a textbook example of the razor-and-blade strategy. The company sold CGM devices (razors) at a lower margin to build its user base and generated recurring revenue from disposable sensors (blades), which needed regular replacement.

Key financial drivers included:

- High Gross Margins: While hardware margins were modest, sensor consumables generated significant profitability due to their low production costs and high-volume sales.

- Recurring Revenue Stream: The consumable nature of sensors created a predictable and growing revenue stream as more patients adopted the technology.

- Operating Leverage: As Dexcom scaled, its fixed costs (R&D, manufacturing infrastructure) were spread across a larger revenue base, driving operating margin expansion.

By 2012, Dexcom was still in the early stages of profitability. However, its revenue growth trajectory, supported by rapid patient adoption and increasing reimbursement coverage, signaled a clear path to sustained financial success.

Key Success Factors and Risks

Dexcom’s strategy revolved around continuous innovation, strong partnerships, and relentless focus on improving patient outcomes. Success factors included:

- Technological Leadership: Dexcom consistently improved sensor accuracy, usability, and integration with insulin pumps.

- Partnerships: Collaborations with companies like Tandem, Insulet, and Edwards Lifesciences expanded its product ecosystem.

- Market Tailwinds: The growing prevalence of diabetes and increasing awareness of CGM benefits drove demand.

However, risks loomed large. Reimbursement challenges, potential product recalls, supplier disruptions, and competitive pressures from Medtronic and new entrants were persistent threats.

Company Evolution

In the decade following 2012, Dexcom became a standout performer in the healthcare sector as the company executed on its vision:

- Reimbursement Breakthroughs: Medicare coverage for CGMs in 2017 unlocked a significant market opportunity, especially among Type 2 diabetics and older populations.

- Technological Advancements: Products like the G6 and G7 systems set new standards for accuracy, ease of use, and integration.

- Market Leadership: Dexcom expanded its market share, outpacing competitors like Abbott and Medtronic through superior technology and customer loyalty.

Today, Dexcom boasts billions in annual revenue, with a global footprint and strong competitive moat.

What Could Investors Have Seen in 2012?

Dexcom’s potential was clear to those who recognized its early achievements and the structural tailwinds driving CGM adoption. Key indicators included:

- Recurring Revenue Model: The razor-and-blade strategy provided a predictable, scalable growth path.

- Technological Edge: Superior accuracy and sensor life positioned Dexcom ahead of rivals.

- Untapped Market: With CGM adoption in its infancy, the runway for growth was massive, particularly among Type 2 diabetics.

- Strategic Partnerships: Collaborations with pump manufacturers demonstrated Dexcom’s commitment to integration and market expansion.

Lessons for Investors

Dexcom’s journey offers valuable insights for investors:

- Innovation and Market Acceptance: We like innovative companies, as Dexcom's sensor was a superior product, and this was also begining to be recognized by the marketplace.

- Understand Market Dynamics: Recognizing structural trends, like the growing prevalence of diabetes, can highlight long-term winners.

- Pay Attention to Business Models: Recurring revenue and high-margin consumables are powerful drivers of financial success.

- Look for Catalysts: Reimbursement breakthroughs, regulatory approvals, and new product launches can serve as inflection points for growth.

Dexcom’s rise from a small innovator to a market leader demonstrates the power of staying ahead of the curve in a rapidly evolving industry. For those who saw the potential early, the rewards have been extraordinary.

Stock Performance

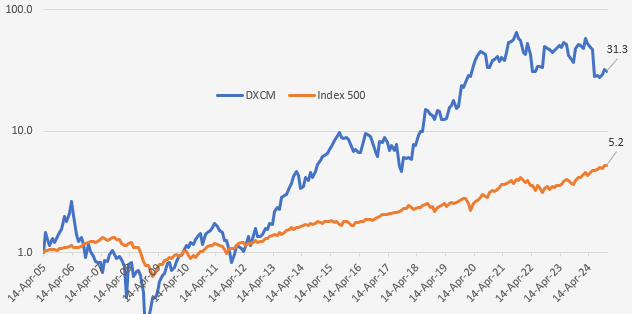

As depicted in the chart above Dexcom's stock performance (DXCM) stock has had periods of volatility, but with upward trajectory.

Here's a breakdown by significant periods:

2005–2011: Post-IPO Struggles and Uncertainty

After Dexcom's IPO in 2005, the company struggled to gain traction with investors due to several factors. The CGM market was nascent, and adoption was slow, partly because of limited reimbursement from insurers and the lack of clinical data supporting CGM's widespread use. Dexcom's early products, while innovative, faced competition from Medtronic's integrated pump and sensor system, which held the dominant market share. The company was not yet profitable, and its reliance on significant R&D investments put pressure on its financials. During this period, the stock was volatile and underperformed broader market indices, as investors remained uncertain about the viability of CGM as a mainstream diabetes management tool.

2012–2015: Early Adoption and Market Recognition

This period marked a turning point. By 2012, Dexcom had achieved critical milestones, including FDA approval for its Gen 4 system, which showcased superior accuracy and convenience. The stock gained momentum as adoption of CGM began to accelerate, driven by increased awareness of its clinical benefits and improving reimbursement policies. During this time, the company also began partnering with insulin pump manufacturers, leveling the playing field with Medtronic. As Dexcom's revenue grew, so did investor confidence, leading to significant stock appreciation.

2015–2016: Temporary Slowdown Amid Growing Expectations

While Dexcom had begun gaining momentum in the early 2010s, the stock experienced a notable slowdown in 2015–2016: Competition from Abbott’s FreeStyle Libre, which launched in Europe in 2014 and began gaining attention in the U.S., raised concerns about pricing pressure and market share erosion. Dexcom’s Gen 5 system faced delays in certain international markets, and investors questioned whether the company could maintain its technological edge. Although revenue growth was strong, the company’s high valuation led to increased scrutiny, and even minor execution risks resulted in pullbacks in the stock price. This period of underperformance was temporary, as the successful rollout of the Gen 5 system and Dexcom’s ability to address reimbursement challenges helped it regain momentum by 2017.

2017–2020: Explosive Growth and Industry Leadership

Dexcom solidified its position as a leader in CGM during this period. The Gen 5 and Gen 6 systems brought significant improvements in accuracy, connectivity, and ease of use, driving widespread adoption among Type 1 and Type 2 diabetes patients. In 2018, Dexcom received Medicare reimbursement for its CGM devices, a monumental achievement that expanded its addressable market. The stock surged as revenue grew rapidly, supported by the razor/razorblade business model, high gross margins, and increasing operating leverage. This period also saw Dexcom's inclusion in the S&P 500, boosting its visibility among institutional investors.

2020: COVID-19 Volatility

During the early stages of the COVID-19 pandemic, Dexcom's stock experienced heightened volatility: While demand for CGM devices remained resilient, supply chain disruptions and temporary delays in new patient starts caused concerns about near-term revenue growth. Broader market sell-offs during the early months of the pandemic also weighed on the stock, although healthcare companies, including Dexcom, rebounded strongly later in the year. Despite the volatility, this period ultimately reinforced Dexcom’s resilience as the company continued to grow its user base and expand its product offerings.

2021–2022: Valuation Compression in a Changing Market

After a period of explosive growth from 2017 to 2020, Dexcom’s stock entered a phase of underperformance. Rising interest rates and a shift in market sentiment away from high-growth, high-valuation stocks led to a broader sell-off in healthcare technology companies, including Dexcom. Concerns about increasing competition, particularly from Abbott’s FreeStyle Libre 3 and Medtronic’s improving CGM offerings, created uncertainty about Dexcom’s ability to maintain its dominant position. Slower-than-expected adoption in certain segments, such as Type 2 diabetes, and delays in expanding into adjacent markets, such as hospitals, contributed to muted investor enthusiasm. While Dexcom’s fundamentals remained strong, these external pressures weighed on the stock, leading to a period of underperformance relative to its historical trajectory.

Overall Performance

From its early days as a small-cap stock to its current position as a multi-billion-dollar industry leader, Dexcom's stock has delivered extraordinary long-term returns. Investors who recognized its potential early—particularly during the 2012 inflection point—were rewarded handsomely as the company grew both its revenue and market share while maintaining its technological edge. Today, Dexcom remains a key player in one of the fastest-growing segments of healthcare technology. Dexcom shares appreciated 31x since its IPO for an annualized return of 19% compared to the broader market return of 5x, or 9% annualized. For an investor who purchased the stock in 2012, those figures would be 23x, or 30% annualized, compared to the broader market of 4x, or 13% annualized.

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in Dexcom. (Dexcom). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.