Case studies

The Art of Timing: How Beyond Meat Rode the Hype Wave

Dec 2024

Beyond Meat’s IPO in May 2019 is a masterclass in how hype and timing can amplify investor enthusiasm, particularly when paired with well-orchestrated near-term catalysts. The company went public during a cultural and market moment when plant-based diets were surging in popularity, thanks to rising awareness of sustainability, health consciousness, and animal welfare. Beyond Meat skillfully leveraged this momentum to present itself as a transformative leader in the trillion-dollar global meat market, painting a vision of unlimited growth potential.

Investors’ confidence in the IPO wasn’t just rooted in the company’s long-term narrative but also in the expectation that its first few quarters would deliver exceptional results. Leading up to its public debut, Beyond Meat strategically aligned several key developments to ensure immediate revenue growth. Aggressive grocery store expansions into major chains like Walmart, Target, and Kroger created a surge in trial purchases from consumers eager to try plant-based alternatives. Meanwhile, high-profile fast-food partnerships with Carl’s Jr., Del Taco, and others generated significant media buzz and drove customer demand. These initiatives gave investors tangible evidence that Beyond Meat’s growth trajectory was accelerating, making the company’s near-term performance seem like a safe bet.

The IPO itself was perfectly timed to coincide with these growth milestones, creating a feedback loop of optimism. At the time, Beyond Meat was one of the only publicly traded pure-play plant-based meat companies, giving it a first-mover advantage in the eyes of investors. Adding to the excitement was the broader hype around the plant-based movement and Beyond Meat’s ESG-driven story, which attracted socially conscious investors and funds eager to align with sustainability trends. Analysts predicted, and investors believed, that the company would exceed early earnings expectations, which would serve as a powerful catalyst to push the stock even higher.

That prediction came true—initially. In its first earnings report as a public company, Beyond Meat delivered a staggering 287% year-over-year revenue growth for Q2 2019, surpassing expectations. These results fueled further confidence in the stock, driving it to new heights. Investors saw Beyond Meat’s ability to execute in the early quarters as validation of its growth story and poured capital into the company, hoping it would continue to dominate an emerging market.

However, much of this early success was transient, tied to the one-time effects of new distribution rollouts and fast-food trials. While expanding into grocery stores created a temporary sales surge, it was harder to replicate once the shelves were stocked nationwide. Similarly, fast-food partnerships often involved limited-time menu items, generating initial excitement but failing to translate into permanent sales channels. Additionally, Beyond Meat’s competitive edge was partly due to timing—its main rival, Impossible Foods, faced supply chain constraints during this period, temporarily leaving Beyond Meat as the dominant player in the grocery sector.

As these short-term catalysts faded, cracks began to appear in Beyond Meat’s business model. Consumer trial rates didn’t always convert into repeat purchases, with some buyers deterred by price, taste, or concerns about ultra-processed foods. Competition intensified as other brands entered the market with comparable or lower-priced products. The company’s reliance on temporary revenue spikes became evident, and sustaining early growth proved challenging.

In hindsight, Beyond Meat’s IPO was brilliantly timed to capitalize on market optimism and short-term wins. The alignment of hype, grocery expansions, and fast-food trials created the appearance of unstoppable momentum, driving the stock to meteoric highs. But as the novelty of plant-based meats wore off and competition grew, the sustainability of its growth came into question. Beyond Meat’s story serves as a valuable lesson for investors: while early success can be a powerful catalyst, it’s critical to evaluate whether a company’s growth drivers are temporary or built on a foundation that can endure beyond the initial hype.

For investors, the type of momentum Beyond Meat’s stock exhibited can be incredibly tempting. At Sunrise Stock Research, while our primary focus is on long-term, sustainable investment opportunities, we recognize that the ultimate goal is to generate returns. A portfolio designed to consistently beat its benchmark—our definition of success—may include a small allocation to momentum-oriented stocks. After all, if we can’t achieve consistent outperformance, we might as well invest in low-cost index funds or delegate the task to professionals, even though most tend to underperform in the long run, and use our time more effectively elsewhere.

When trading momentum-driven stocks like Beyond Meat, discipline is key. Following our rules for trading these types of stocks can help investors maximize gains while managing risks effectively, ensuring momentum plays contribute positively without derailing a thoughtfully constructed portfolio.

How an Investor Might Profit

Profiting from Beyond Meat’s explosive IPO and early rally as a “momentum” investment required a disciplined, tactical approach. This type of opportunity hinged on capitalizing on short-term market enthusiasm while recognizing the temporary nature of the stock's initial success. Here's how an investor might have navigated Beyond Meat's meteoric rise:

1. Understand the Nature of the Opportunity

Beyond Meat’s IPO wasn’t just an entry into the public markets; it was a cultural phenomenon. The company represented a disruptive force in the plant-based food industry, tapping into consumer trends like sustainability, health, and ethical eating. However, the early rally was fueled more by investor excitement and scarcity value than by long-term operational strength. Investors needed to approach Beyond Meat as a momentum-driven trade rather than a fundamental, long-term holding. The goal: capitalize on hype and early growth, not bet on sustained profitability or market dominance.

2. Look for Catalysts

Momentum investors would have identified specific post-IPO catalysts that fueled Beyond Meat’s early rise, including:

- Fast-Food Partnerships: High-profile trials with Carl’s Jr., Dunkin’, and McDonald’s signaled rapid adoption by major players, driving optimism.

- Grocery Store Expansion: Aggressive rollouts in retail outlets like Kroger and Walmart created excitement about distribution growth.

- Earnings Surprises: Early earnings reports exceeded expectations, validating the hype temporarily.

- Scarcity Value: As one of the first plant-based food companies to go public, Beyond Meat attracted attention as a unique investment opportunity.

Recognizing these catalysts would have allowed investors to ride the stock’s upward momentum while staying alert to signs of slowing growth.

3. Monitor Valuation Closely

As Beyond Meat’s stock price soared post-IPO, reaching over $200 within months, its valuation became increasingly disconnected from its fundamentals. An astute investor would have tracked key metrics like revenue growth, gross margins, and cash burn. Signs of unsustainability—such as slowing sales growth or mounting competition—would have signaled a need to reassess.

At its peak, Beyond Meat was trading at an astronomical price-to-sales ratio, far exceeding that of established food companies. This kind of overvaluation often indicates that momentum is nearing its peak.

4. Set Exit Triggers

Momentum trades require clear exit criteria to avoid being caught in the inevitable decline. For Beyond Meat, disciplined investors might have set triggers such as:

- Price Targets: Selling at pre-determined price levels, such as when the stock surpassed $200, based on optimistic projections of future growth.

- Time Horizon: Recognizing that IPO-fueled rallies often lose steam after the first few quarters, setting a 6–12 month timeframe for exiting.

- Earnings Misses: Exiting at signs of declining revenue growth, such as when restaurant trials slowed or grocery store sales plateaued.

5. Avoid Getting Greedy

One of the biggest risks in momentum investing is holding on too long, hoping for further upside. For Beyond Meat, warning signs emerged as early as late 2019:

- Intensifying Competition: Rivals like Impossible Foods and traditional meat companies entering the plant-based market.

- Slowing Growth: Sales growth began to decelerate as the novelty wore off and initial distribution opportunities were exhausted.

- Valuation Disconnect: The stock's price reflected perfection, leaving little room for error.

Exiting before these issues became fully evident would have been crucial to locking in profits.

6. Use a Hedging Strategy

To manage downside risk, investors could have employed hedging strategies during the rally:

- Stop-Loss Orders: Setting stop-loss orders just below recent price levels to protect against a sudden downturn.

- Options Strategies: Using put options to hedge against the possibility of an unexpected earnings miss or market sentiment shift.

These tools would have allowed investors to participate in the upside while guarding against sharp declines

.

7. Focus on Market Sentiment

Beyond Meat’s stock was highly influenced by investor sentiment rather than long-term fundamentals. Paying attention to shifts in narrative—for example, increasing skepticism about profitability, competition, or slowing adoption rates—would have been critical in identifying when the window for gains was closing. Media enthusiasm around plant-based diets and sustainability also played a major role in fueling the rally, so declining coverage or negative press could signal a turning point.

Key Lessons for Momentum Investors

- Capitalize on Catalysts: Early successes, such as distribution deals and earnings beats, create opportunities for gains, but they are often front-loaded.

- Recognize Temporary Hype: IPO rallies are often driven by excitement and scarcity rather than sustainable growth.

- Set Clear Rules: Pre-determined price targets, timeframes, and risk management strategies help ensure disciplined exits.

- Monitor Sentiment and Fundamentals: Watch for shifts in the narrative or weakening fundamentals that could derail momentum.

Beyond Meat’s IPO provided a textbook example of a momentum-driven opportunity with a short shelf life. While the stock rewarded disciplined investors in the early months, those who failed to recognize its speculative nature risked being caught in its eventual decline. This highlights the importance of a tactical approach when trading IPO-driven momentum.

Stock Performance

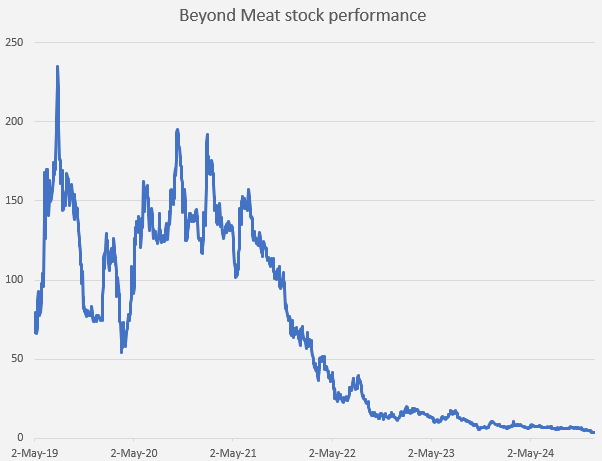

Beyond Meat’s stock performance has been a rollercoaster, reflecting the dramatic shift from early optimism to the harsh realities of sustaining long-term growth in a competitive market. When the company went public in May 2019 at $25 per share, investor enthusiasm sent the stock soaring. Beyond Meat ended its first day of trading up over 160%, closing at $65.75. This marked one of the most successful IPO debuts in recent history, and the momentum didn’t stop there. Within just three months, the stock hit an all-time high of $234 per share, representing an 840% increase from its IPO price.

Early Success: Fueled by Hype and Catalysts

The initial surge in Beyond Meat’s stock price was driven by a combination of hype surrounding the plant-based food movement and strong near-term performance. The company delivered stellar quarterly results in its first few earnings reports, significantly exceeding revenue expectations. These strong results validated investor confidence and created a sense of inevitability about Beyond Meat’s growth story. The company’s aggressive grocery store rollouts and fast-food trials during this period acted as clear growth catalysts, convincing investors that the company was poised to dominate the emerging plant-based meat market.

Beyond Meat also benefited from its unique position as one of the only publicly traded pure-play plant-based meat companies. This scarcity factor, combined with the ESG appeal of its mission, attracted a wide range of retail and institutional investors eager to capitalize on the next big food trend.

The Decline: From Growth Star to Troubled Performer

However, the stock’s meteoric rise was unsustainable. By late 2019, cracks began to appear in Beyond Meat’s growth story. While revenue continued to grow, the pace of expansion slowed as the company faced increasing competition from rivals like Impossible Foods and traditional meat companies entering the plant-based market. By early 2020, the stock had fallen below $100 per share.

The COVID-19 pandemic initially provided a temporary boost to sales, as grocery demand surged while restaurants shut down. However, the pandemic also exposed the company’s reliance on foodservice partnerships, many of which failed to scale beyond limited trials. When fast-food chains like McDonald’s and KFC either paused or ended partnerships with Beyond Meat, it raised questions about the company’s ability to establish long-term distribution channels.

Additionally, the broader economic environment, including rising inflation, hurt consumer demand for Beyond Meat’s premium-priced products. By 2022, the stock had fallen below its IPO price, marking a stunning reversal of fortune.

Current Performance: A Struggling Stock

As of late 2024, Beyond Meat’s stock trades well below its peak, reflecting significant challenges in maintaining growth and profitability. The company has faced persistent issues, including declining consumer demand, competitive pressures, and mounting losses. Investors have grown increasingly skeptical of its ability to achieve sustainable profitability, leading to continued downward pressure on the stock.

Overall

This is a powerful lesson in the dual-edged nature of hype and momentum. While these forces can create incredible opportunities for short-term gains, they also come with significant risks. Capturing those gains requires a disciplined approach, clear exit strategies, and the ability to separate emotion from decision-making. Beyond Meat’s IPO is a reminder that while market excitement can be profitable, staying grounded in a well-defined strategy is essential to navigating the risks and ensuring success

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in BYND. (Beyond Meat). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.