Case studies

The FirstService Formula: Spin-Off Success and Steady Growth

Dec 2024

In 2015, an unassuming yet promising company emerged from the shadow of its parent organization, Colliers International Group (CIGI). That company was FirstService Corporation (FSV), a leader in residential property management and essential property services. While largely unknown to many investors at the time, FirstService has since carved out a strong position in the market, delivering consistent growth and value. Its story offers a compelling example of how spinoffs can unlock potential and reward patient investors.

The Spin-Off Story

FirstService Corporation was spun off from Colliers International in June 2015. The split created two independent entities, each with a distinct focus:

- Colliers International Group (CIGI): A global leader in commercial real estate services.

- FirstService Corporation (FSV): A North American specialist in residential property management and branded property services.

The rationale for the spin-off was clear: by separating the two businesses, each could focus on its core competencies and operate with greater autonomy. This strategic move was designed to:

- Enhance operational efficiency.

- Provide clearer financial transparency for investors.

- Unlock hidden value in both companies.

- While Colliers pursued opportunities in the global commercial real estate market, FirstService turned its attention to expanding its leadership in residential property services. For investors, this separation allowed them to gain exposure to two distinct growth stories.

A Great Business in the Making

At the time of the spin-off, FirstService was not widely recognized by the investment community. However, those who looked closely discovered a company with an enviable business model and significant growth potential. FirstService operates in two primary segments:

- FirstService Residential: The largest provider of property management services to residential communities in North America. This segment generates stable, recurring revenue through long-term contracts with homeowner associations, condominiums, and planned communities

- FirstService Brands: A portfolio of trusted brands offering essential property-related services, including:

- Paul Davis Restoration: Disaster recovery and property restoration.

- California Closets: Custom home storage solutions.

- CertaPro Painters: Residential and commercial painting services.

- Pillar To Post: Home inspection services.

Both segments benefit from strong market positions and recurring revenue streams, providing FirstService with stability and growth opportunities even during economic uncertainty.

Financial Model

FirstService’s financial model is built on stability, scalability, and recurring revenue. Here’s a closer look:

- Recurring Revenue Streams: A significant portion of revenue comes from property management contracts, which are long-term and typically renewed automatically. This ensures a steady cash flow that provides predictability in earnings.

- Scalable Franchise Model: The FirstService Brands segment operates on a franchise-based model, where franchisees pay royalties based on revenue. This low-capital-intensity approach allows the company to scale without significant investment in physical infrastructure.

- Diversified Revenue Sources: With operations across multiple service areas, FirstService reduces its dependence on any single revenue stream, ensuring resilience against market-specific downturns.

- Asset-Light Strategy: By focusing on management and franchise fees rather than owning assets, FirstService maintains high margins and a flexible balance sheet.

- Acquisition-Fueled Growth: Strategic acquisitions have bolstered both segments, enabling the company to enter new markets and expand its service offerings. Acquisitions are funded prudently, ensuring they enhance shareholder value without overleveraging the balance sheet.

- Organic Growth Rates: FirstService consistently achieves mid-to-high single-digit organic growth rates. This is driven by increasing property management contracts, expanding service offerings, and robust same-store sales growth within its franchise operations. The company’s ability to retain and upsell to existing clients has also supported strong organic growth.

- Margins and Profitability: FirstService’s asset-light and recurring revenue model contribute to attractive operating margins. The property management segment enjoys stable margins due to the recurring nature of its contracts, while the branded services segment benefits from scalable franchise operations. Overall, the company’s EBITDA margins typically range between 10% and 12%, reflecting a balance of stability and growth.

Analyzing FirstService Using Porter’s Five Forces

To better understand FirstService’s competitive position, we can apply Michael Porter’s Five Forces framework:

- Threat of New Entrants: The property management and branded services sectors have moderate barriers to entry. While starting a service company is relatively low-cost, achieving scale and building trusted brands like FirstService’s takes significant time and resources. FirstService’s established reputation, extensive network, and recurring revenue model make it difficult for new entrants to compete effectively.

- Bargaining Power of Suppliers: Suppliers play a limited role in FirstService’s operations since it primarily offers services rather than products. Labor costs are a significant input, and while tight labor markets can increase costs, the company’s scalable franchise model spreads this risk to franchisees.

- Bargaining Power of Buyers: Customers in property management and services have some bargaining power, particularly in large residential communities or commercial contracts. However, FirstService’s strong market position and the essential nature of its services reduce price sensitivity. Its high customer retention rates indicate satisfaction and limited buyer power.

- Threat of Substitutes: Substitution risk is low. Property management and essential services are necessities for communities and homeowners. While customers could switch to competitors, FirstService’s strong brand portfolio and quality service offerings reduce this risk.

- Industry Rivalry: The industry is competitive but fragmented. FirstService’s scale and market leadership give it a distinct advantage. Smaller competitors struggle to match its service breadth, brand recognition, and ability to offer integrated solutions across multiple segments.

Post-Spin-Off Performance

Since becoming an independent company, FirstService has delivered impressive results. The company’s focus on operational excellence and strategic acquisitions has allowed it to scale effectively, gaining market share in its core businesses. Key highlights of its post-spin-off performance include:

- Consistent Revenue Growth: Driven by its recurring service contracts and expanding portfolio of brands.

- Resilience in Tough Markets: The essential nature of its services—property management, restoration, and maintenance—ensures demand even in challenging economic conditions.

- Successful Acquisitions: FirstService has strategically acquired niche businesses to bolster its service offerings and geographic reach.

Stock Performance

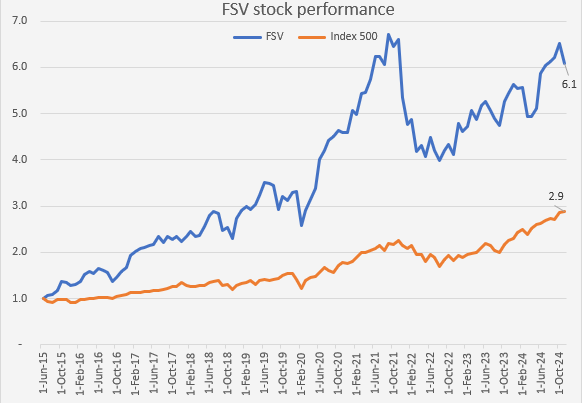

FirstService’s stock has been a consistent performer since its spin-off in 2015. Investors who got in early have enjoyed solid rewards:

The stock has delivered impressive annualized returns of 21%, outpacing the broader market of 12% annualized. Its business model, built on recurring revenue, has provided stability during market downturns, helping it weather economic challenges with minimal volatility.

Long-term growth has been supported by organic initiatives, smart acquisitions, and steady margin expansion, making it a reliable choice for investors seeking both growth and resilience. Though the stock trades at a premium compared to some competitors, its market leadership and consistent cash flow generation justify the valuation.

Lessons for Investors

FirstService’s success story offers valuable insights for investors:

- Don’t Overlook Smaller Companies: Some of the best opportunities come from under-the-radar businesses with great fundamentals. FirstService wasn’t a household name, but its solid recurring revenue model and strong market position made it a winner.

- Appreciate Recurring Revenue: Predictable, steady income streams are the backbone of stability in any business, and FirstService exemplifies how this can provide a firm foundation for growth.

- Spinoffs Can Be Hidden Gems: By separating from Colliers, FirstService unlocked its potential, giving investors a chance to capitalize on its focused strategy and operational excellence.

Conclusion

FirstService Corporation’s journey from an overlooked spin-off to a market leader in property services is a testament to the power of strategic autonomy and operational focus. For investors who took the time to understand its business model and recognize its potential, the company has been a rewarding success story. Today, FirstService stands as a shining example of how spinoffs can transform underappreciated businesses into stock market darlings.

Disclosure: This case study is provided for illustrative and educational purposes only and should not be considered a recommendation or investment advice. The author may hold shares in FSV. (FirstService). Before making any investment decisions, please consult the company’s prospectus and/or your financial advisor. Past performance is not a guarantee of future results.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.