Decades of Policy Missteps: How U.S. Leaders Enabled China's Economic Ascent -April 2025

During my studies at the University of Michigan, international trade theory was a central focus. One foundational concept is the Theory of Comparative Advantage, introduced by David Ricardo in 1817 in his book On the Principles of Political Economy and Taxation. This theory posits that countries should specialize in producing goods they can produce relatively more efficiently than others and trade for the rest. Over the past two centuries, this principle has significantly influenced global trade policies.

Trade is a fundamental aspect of economics, whether among individuals or nations. The prevailing belief is that trade benefits all parties involved, leading to increased efficiency and optimal outcomes driven by market forces. However, when applied to international relations, the dynamics become more complex.

Countries positioned lower in the global economic hierarchy often strive to ascend, seeking to enhance their economic standing. Nations with differing political systems, such as China, may not adhere to the same trade norms. China, for instance, has been known to restrict access to its markets while enjoying broad access to others, including the U.S. It employs tariffs, subsidies, and regulations to protect its industries, making it challenging for foreign companies to compete, even when they possess significant comparative advantages. Moreover, issues like intellectual property (IP) theft have been persistent, with limited recourse for affected foreign businesses.

China takes a long term approach with their economy with a 100 year plan. This is in contrast the short term orientation of U.S. policy where politicians are more focused on the election cycle. China has strategic industries they protect and promote. These are advanced manufacturing (such as robotics and automation), high tech industries (information technology, telecommunications, artificial intelligence, and aerospace), New Energy and Clean Technology (solar, wind, and EVs), Biotechnology and Healthcare, Agriculture and Food Security, and High-End Equipment Manufacturing, Aerospace and Space Technology. China has already become the global leader in some of these technologies.

For decades, the U.S. and other developed nations operated under the assumption that trade would yield mutual economic benefits and foster diplomatic cooperation. There was also a belief that China's economic development would lead to more liberal and democratic policies and fairer trade practices. Regrettably, these expectations have not materialized as anticipated.

Over the past 30 years, policies have facilitated rapid globalization. However, recent events have begun to challenge this trend:

- COVID-19 Pandemic: Exposed the vulnerabilities of deeply integrated global supply chains.

- Russian Invasion of Ukraine: Highlighted geopolitical risks affecting global trade.

- Escalating U.S.–China Trade Tensions: Including significant tariff increases and strategic competition.

In the coming decades, nations are likely to prioritize security in areas such as food, energy, cybersecurity, and national defense. This shift may lead to reduced globalization, increased emphasis on self-sufficiency, resource redundancy, and potentially decreased efficiency..

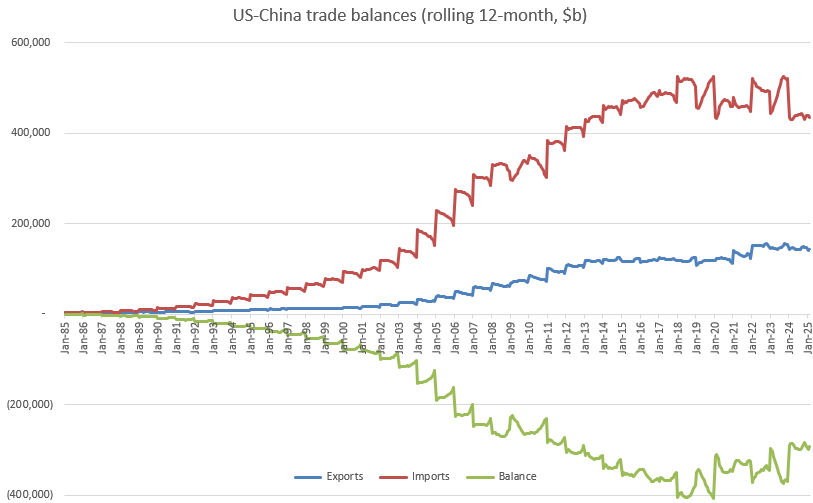

Source: US Census Bureau

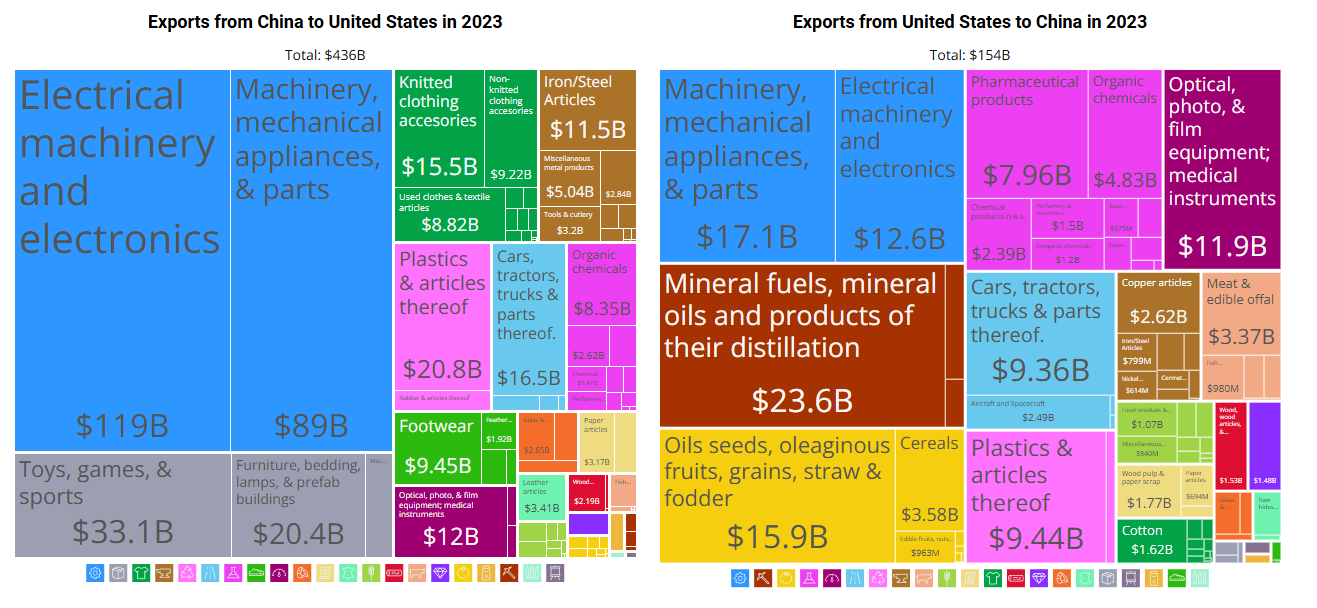

The imbalances in U.S.–China trade are particularly striking. In 2024, the U.S. imported approximately $438.9 billion worth of goods from China, equating to about $3,700 per household. This is a wholesale figure, so retail spending on Chinese goods is likely $7500 per household. Conversely, U.S. exports to China totaled around $143.5 billion, primarily consisting of low value-added commodities like food and raw materials, along with machinery likely used to produce goods exported back to the U.S. Only about $50 billion comprised finished goods such as automobiles, indicating a significant trade imbalance.

Source: OEC

Additionally, the dependence of some U.S. companies on China is concerning. For example, 85-90% of Apple's products are manufactured in China. While Apple has made efforts to diversify its supply chain, the American consumer also plays a role by consistently choosing to purchase goods manufactured in China.

Addressing these challenges will require time and concerted effort. The current situation is the result of decades of policy decisions, and reversing course won't happen overnight. Our leaders have failed to respond to issues like IP theft and market access barriers. Reducing reliance on China will be a gradual and potentially painful process, affecting workers and small businesses in both countries.

These trade disputes tie into a greater geopolitical dynamic in controlling China’s global strategic ambitions in light of China’s assertiveness to enhance its influence around the world. This includes the Belt and Road Initiative to make investment in infrastructure throughout Asia and Africa, its’ strategic interest in investment in Greenland and the Panama Canal, it’s aggression in the South China sea where China has built and militarized artificial islands and military incursion with many of its neighbors, and the continued claims on Taiwan and its intention to “reunify” the territory, which some analysts believe may be planned within the next 3 years. China has also supported Russia in its invasion of Ukraine and the two countries announced a “no limits” strategic partnership just days before Russia’s invasion. China has supplied Russia with critical rare earth elements for continuing its war and had provided a market for Russian oil and gas.

These elements highlight the increasing risk of military conflict with China especially with regards to China’s intention toward Taiwan. While no one could wish for such an outcome as it would be devasting, we cannot rule out this a risk. A blockade or invasion of Taiwan would cripple the global economy, not only due to our reliance on these countries in our supply chain, but that Taiwan produces 90% of the global supply of advanced semiconductor chips. Worse yet would be a successful invasion of Taiwan which delivers to China near complete control of this manufacturing. These are risks almost no one talks about. I would expect any incursion into Taiwan would result in direct military conflict with the U.S. as we would not allow China to achieve this.

The tariff war could accelerate the conflict with China. With its economy already on the brink of falter, China may act out of desperation to achieve its ambitions toward Taiwan. Already cut off from an effective embargo for exports to the U.S. they may feel they have little to lose in pressing the issue. China has already vowed to “fight to the end”. While investors fear a global trade war, there are greater things to fear.

My hope and belief is a significant softening toward China versus the 145% tariff the President has announced. While we recognize the need to rebalance the trading relationship with China, a more measured approach is more sensible, which is why I think the President’s stance is likely to soften over the coming months. A more sensible policy is to increase tariffs gradually, such as turning up the heat on the frog analogy, which reduces the shock to the system while achieving the desired trade rebalancing over time.

Investment Implications

Investors should remain selective, but caution is warranted. While recent sell-offs have created potential opportunities, it’s likely too early to buy aggressively. We need to see material progress on trade negotiations—or at least a clear shift toward de-escalation and lower trade barriers—before confidence can return. Until then, volatility may persist, and patience is key.

National Economic Council Director Kevin Hassett recently stated that “more than 10” countries have made “very good, amazing” trade deal offers. Progress on these deals would help instill confidence, and their structure will shed light on the President’s broader goals. However, comprehensive trade agreements take time. A deal with China—given its complexity and scale—will likely be among the last to be completed, extending the timeline for full resolution.

Earnings estimates for many companies will need to be adjusted to reflect the anticipated impact of tariffs. Typically, stocks fall as earnings are revised downward. However, because many stocks have already sold off in anticipation of these effects, investors may give companies a pass for lowering guidance during Q1 earnings season. Q2 results, on the other hand, are more likely to reflect the true impact—potentially leading to a high number of negative surprises.

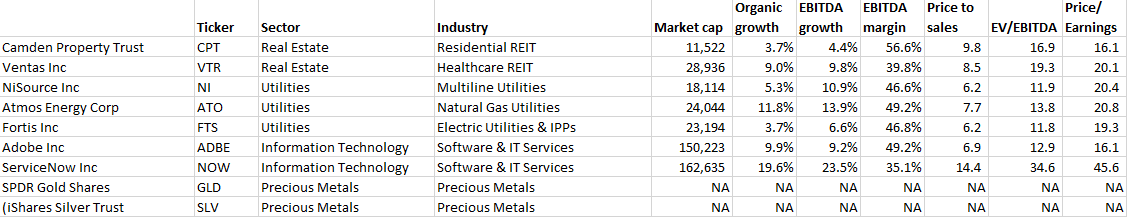

To brace for this uncertain environment, we recommend investors stay engaged with the market but orient their portfolios toward defensive positions. We highlight REITs, utilities, and precious metals as sectors that could fare well in this environment. We’ve also taken positions in select software companies with predictable, recurring revenue due to their subscription-based models. Many of these stocks have pulled back and now trade at more reasonable valuations.

Highlighted positions include:

REITs: CPT (Camden Property Trust), VTR (Ventas)

Utilities: NI (NiSource), ATO (Atmos Energy), FTS (Fortis)

Precious Metals: GLD (SPDR Gold Shares), SLV (iShares Silver Trust)

Software: ADBE (Adobe), NOW (ServiceNow)

Bottom Line:

This is not the moment to go all-in, but it’s also not the time to sit on the sidelines. Trade tensions are fueling fear, but fear can create opportunity. Stay focused, stay selective, and lean into quality. Look for companies with real pricing power, recurring revenue, and the balance sheets to weather volatility. A trade reset may take time—but when it comes, the market will move fast. Be ready, not reactive.

Disclosures:

The information contained in this communication is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any securities. The securities mentioned, including CPT, VTR, NI, ATO, FTS, GLD, SLV, ADBE, and NOW, are held in client portfolios at the time of publication but are subject to change without notice. All investing involves risk, including the potential loss of principal. Past performance is no guarantee of future results. Investors should conduct their own due diligence or consult a financial advisor before making any investment decisions.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.