A Trillion Here, a Trillion There, Pretty Soon We’re Talking About Serious Money -Dec 2024

The Unstoppable Rise of U.S. Debt

The Congressional Budget Office (CBO) projects annual deficits to persist indefinitely, with federal debt surpassing 150% of GDP in the next 20 years. At that point, many economists believe the U.S. will hit a tipping point where no mix of tax increases or spending cuts can reverse course. When debt reaches these levels, the government’s ability to respond to crises is severely hampered. Historically, every decade or so, the U.S. faces a major financial crisis. During these events, the government steps in with significant stimulus to support the economy. The COVID-19 crisis, for example, prompted nearly $5 trillion in federal stimulus, and we continue to add nearly $2 trillion annually to the national debt.

What’s particularly alarming is the context of today’s deficit. Historically, deficits spike during recessions as the government stimulates growth. But today, we’re running a deficit of 6% of GDP during full employment, something unprecedented in U.S. history. By 2034, the CBO projects a $2.5 trillion annual deficit, with two-thirds of that deficit coming from interest payments alone. What happens when the next economic downturn hits? If we’re already running deficits during prosperous times, the deficit could balloon even further during a slowdown. With interest rates already at low levels, our leaders are setting themselves up to be boxed in, with few tools to respond to crises.

Inflation is the most politically palatable “solution”

If federal debt continues to rise unchecked, balancing the budget would require extreme measures—either raising taxes by 40% or cutting spending by 28%. Both are politically implausible and economically disruptive. More likely, we’ll see a slow, inflationary default where the government prints its way out of debt while lying about the amount of inflation it causes.

The government has a strong incentive to create inflation. Inflation reduces the real value of accrued government debt, allowing it to be repaid with cheaper dollars. The Federal Reserve targets a 2% inflation rate—an official admission that they want the purchasing power of your money to fall each year. Inflation increases financial asset prices from stocks to houses, boosting tax revenues.

For investors this acts as a stealth wealth tax, something that appeals to many policymakers, Paying taxes on nominal gains that barely keep up with inflation feels unfair, but that’s the world we live in.

Moreso, the government has a strong incentive to underreport inflation, and the numbers suggest it’s already happening. Underreporting inflation reduces government obligations that are inflation-adjusted, such as Social Security payments. Additionally, tax brackets are adjusted based on inflation, so if wages rise faster than reported inflation, more people are pushed into higher tax brackets—creating a hidden tax increase.

Official Numbers Understate True Inflation

The Federal Reserve’s primary responsibility is to balance the rate of inflation with the risks in the labor market. Despite consistently missing the mark on their 2% inflation target, the government cheats a little to hide the true rate of inflation. While the official government CPI stats show prices rose 33% over the past decade, major consumer costs like cars, housing, and healthcare have surged nearly 50%. Alternative measures, such as Shadowstats, suggest inflation is running about three percentage points higher than official government statistics. This gap between official data and consumer experience is widening, and it’s likely to continue.

Manipulating the Inflation Basket

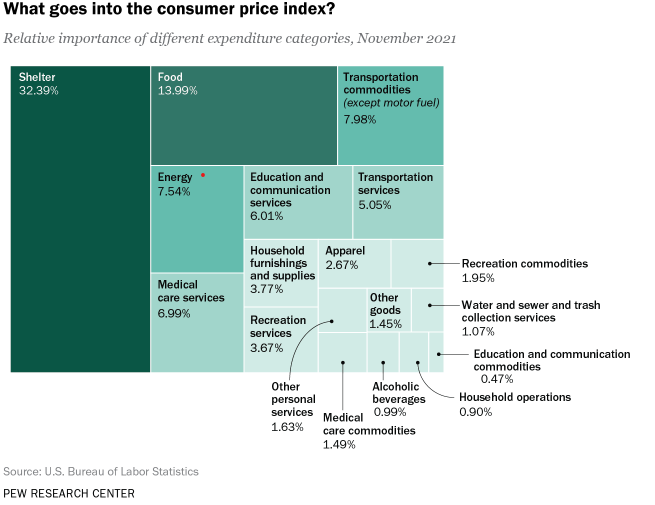

The government gauges inflation through a basket of goods and services. However, every household’s inflation rate differs, depending on lifestyle, location, and spending habits. For instance, young families may care more about rent and car prices, while seniors prioritize healthcare. Medical care, which typically rises faster than other costs, makes up just 7% of the official inflation basket—even though healthcare represents 18% of U.S. GDP. This raises questions about whether the basket is curated to show a lower inflation rate.

Additionally, when consumers substitute lower-priced goods as prices rise, the government calls this the “substitution effect,” which lowers the official inflation number. But this doesn’t capture the decline in satisfaction when consumers are forced to switch to cheaper alternatives.

The government also adjusts for quality improvements. For example, if a new TV has more features, they claim the price has effectively gone down. Yet, they don’t account for declines in service quality, like longer wait times or fewer customer services. For example, it is harder to fix your car on your own than in years’ past. Recently the bankruptcy of drug stores has forced seniors to drive a couple miles more to get their prescriptions. There was a time when gasoline stations were full service, and they would even wash your windows while you wait. These are but some examples of changes in service levels that rarely are accounted for because doing so would undermine the government’s desired narrative.

Balancing Long-Term Risks and Short-Term Gains

For investors, balancing long-term risks with short-term gains is crucial. Holding cash or investing in government bonds feels safe, but comes at the cost of real purchasing power loss. Looking back to 2014, a 10-year U.S. Treasury bond yielded 2.5%. After taxes, you’d net just 1.8% annually, while official inflation was 3.3% and an unofficial rate closer to 5%. Investors lost purchasing power on these bonds, while the government borrowed at a negative real interest rate. For an investor with a long term time horizon, this is a huge mistake.

The alternative has to be risk assets. Inflation’s downstream effect is to increase asset prices, so investors need to focus on assets that can keep up with rising costs. Real estate, particularly properties with inflationary pricing power, offers strong protection against long-term inflation. Apartments are especially attractive due to short-term leases, flexible financing, and a structural undersupply of housing. For those looking for less hassle, Real Estate Investment Trusts (REITs) provide ease of investment and liquidity. One of my favorites in this space is Camden Properties Trust (CPT), which owns a diversified portfolio of apartments in high-growth markets like Texas and Florida.

Closing Thoughts

The government has an official policy to create inflation, and the incentives to understate it. The evidence suggests inflation will continue at rates higher than reported. For investors, this means a balancing act between near-term opportunities and long-term risks. Staying vigilant, investing in inflation-resistant assets, and preparing for a future where the government’s balance sheet is an economic liability are prudent steps forward.

Required reading:

How Health Insurance Costs Outpace Inflation, in Charts - WSJ

Why Cars Have Become Difficult -- And Expensive to Repair

https://www.wsj.com/articles/SB120671829721371953

Why your drug store is closing (https://www.cnn.com/2024/10/16/business/walgreens-cvs-store-closures/index.html#:~:text=CVS%20is%20closing%20900%20stores,1%20in%207%20will%20disappear.)

The Budget and Economic Outlook: 2024 to 2034 https://www.congress.gov/118/meeting/house/116833/witnesses/HHRG-118-BU00-Wstate-SwagelP-20240214.pdf

Meet skimpflation: A reason inflation is worse than the government says it is

Shadow Government Statistics: Analysis Behind and Beyond Government Economic Reporting

https://www.shadowstats.com/alternate_data/inflation-charts

Disclaimer:

This note is provided for informational purposes only and should not be construed as financial or investment advice. All investments involve risk, and past performance is not indicative of future results. The views expressed are those of the author and do not necessarily reflect the views of any affiliated entities. Investors should perform their own due diligence or consult with a financial advisor before making any investment decisions. The specific securities and investments mentioned, including Camden Properties Trust (CPT), are discussed solely for illustrative purposes and should not be considered an endorsement or a recommendation to buy or sell any security. The information provided is based on publicly available data as of the date of publication and is subject to change.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.